Donating to charitable organizations is a wonderful way to give back to the community and support causes that are important to you. Whether you donate money, goods, or services, it’s essential to obtain a donation receipt for your records.

A donation receipt is a document provided by the charity or nonprofit organization to acknowledge your contribution. This receipt is not only important for tax purposes but also serves as a record of your charitable giving.

What is a Donation Receipt?

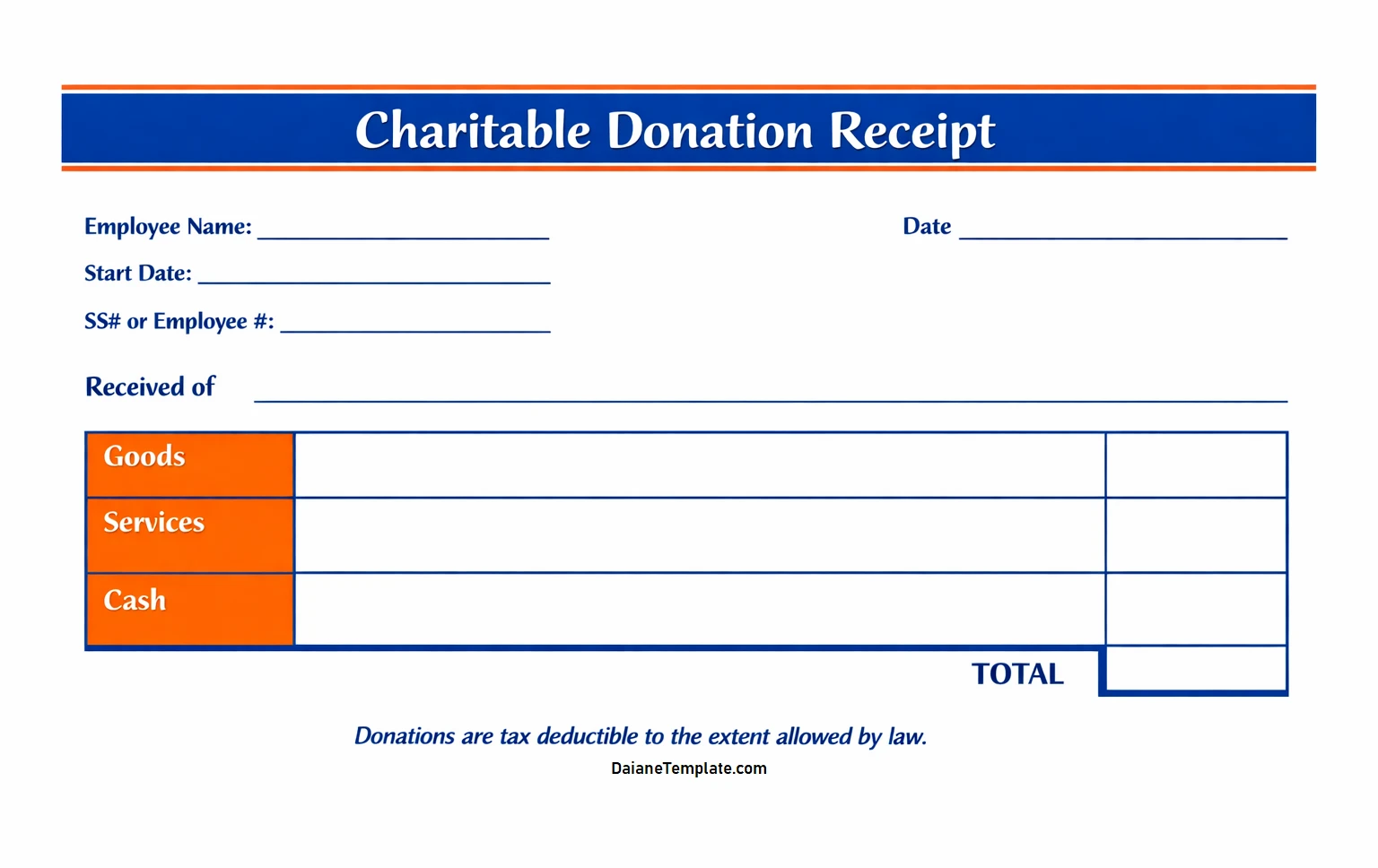

A donation receipt is a written acknowledgment from a charitable organization that confirms the donation made by an individual or entity. This document typically includes the name of the donor, the amount or value of the donation, the date of the contribution, and the name of the organization receiving the donation.

Donation receipts are essential for individuals who want to claim a tax deduction for their charitable contributions.

Why are Donation Receipts Important?

Donation receipts serve several important purposes for both the donor and the charitable organization. For donors, a receipt is necessary to claim a tax deduction for the donation on their annual tax return. Without a valid receipt, the IRS may not allow the deduction.

For charitable organizations, providing donation receipts demonstrates transparency and accountability to donors. It also helps them track and manage donations effectively.

What to Include in a Donation Receipt

When receiving a donation receipt from a charitable organization, it should contain specific information to be considered valid for tax purposes. The receipt should include:

- Name of the donor: The full name of the individual or entity donating.

- Amount or value of the donation: The monetary value of the donation or a description of the donated goods or services.

- Date of the contribution: The date when the donation was made.

- Name of the charitable organization: The legal name of the nonprofit receiving the donation.

- Statement of no goods or services received: If no goods or services were provided in exchange for the donation.

- Tax-exempt status: The organization’s tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

How to Obtain a Donation Receipt

Donation receipts can be obtained in various ways, depending on how the donation was made. If you donate online, the organization may automatically send you a receipt via email. For donations made in person or by mail, you can request a receipt from the organization. It’s important to keep all donation receipts organized and filed for easy access when it’s time to file your taxes.

Tips for Successful Donation Receipt Management

Proper management of donation receipts is crucial for maximizing tax benefits and staying organized. Here are some tips to help you keep track of your charitable contributions effectively:

- Organize receipts by year: Keep donation receipts organized by tax year to make it easier to find them when needed.

- Backup digital copies: Scan or take photos of paper receipts and store them securely on your computer or in the cloud.

- Keep detailed records: Make notes on receipts regarding the purpose of the donation or any restrictions specified by the organization.

- Consult a tax professional: If you have questions about claiming deductions for your donations, seek advice from a tax professional.

- Review donation policies: Familiarize yourself with the donation policies of the organizations you support to ensure compliance with tax regulations.

- Stay informed: Stay up-to-date on changes to tax laws and regulations that may impact your charitable giving and tax deductions.

Donation Receipt Template – DOWNLOAD