Company receipts are more than just pieces of paper or digital files documenting a financial transaction. They serve as critical tools for businesses and customers alike, offering a wealth of benefits beyond mere proof of payment.

In this in-depth guide, we will explore the multifaceted importance of company receipts, delve into what they should include, provide tips for maximizing their utility, and offer insights into effective receipt management practices.

What are Company Receipts?

Company receipts are tangible or digital documents issued by businesses to customers following a completed transaction. These receipts detail essential information about the transaction, including the date, items purchased, quantity, unit price, subtotal, taxes, fees, and the total amount due.

They serve as a binding record of the transaction, offering both the business and the customer tangible proof of the exchange that took place.

Why are Company Receipts Important?

The importance of company receipts cannot be overstated, as they play a pivotal role in maintaining accurate financial records, tracking income and expenses, ensuring tax compliance, and facilitating seamless audits. For businesses, receipts are indispensable tools for monitoring cash flow, analyzing spending patterns, and making informed financial decisions.

Financial Record-Keeping

Company receipts are essential for maintaining detailed and accurate financial records. They provide a clear trail of transactions that can be referenced for accounting, budgeting, and financial analysis purposes.

Income Tracking

Receipts help businesses track their income by documenting every sale or service provided. This information is crucial for assessing revenue streams, identifying profitable products or services, and monitoring overall financial performance.

Expense Management

On the flip side, receipts also play a vital role in expense management. By retaining and categorizing receipts, businesses can keep tabs on their spending, identify areas where costs can be reduced, and ensure that expenses align with their budgetary goals.

Tax Compliance

Receipts are critical for tax compliance, as they provide evidence of business expenses that can be deducted from taxable income. This documentation is essential for accurately reporting income, claiming deductions, and meeting regulatory requirements.

Audit Trail

Receipts serve as an audit trail that can be used to verify financial transactions during internal or external audits. They provide a detailed account of each transaction, helping to ensure transparency and accountability in the event of an audit.

Proof of Purchase

For customers, receipts serve as proof of purchase. They provide assurance that a transaction took place, outline the terms of the purchase, and act as evidence in the event of returns, exchanges, or warranty claims.

Expense Tracking

Customers can use receipts to track their personal or business expenses. By retaining and organizing receipts, individuals can gain insights into their spending habits, identify areas for improvement, and create a more effective budget.

What to Include in Company Receipts?

When issuing company receipts, it is crucial to include specific information to ensure they are comprehensive, accurate, and compliant with legal requirements. These key elements help both businesses and customers understand the details of the transaction and maintain proper records for future reference.

Business Details

Include the name, address, and contact information of the business on the receipt. This information helps customers identify where the transaction took place and provides them with a point of contact for any follow-up inquiries.

Customer Details

Include the name, address, and contact information of the customer on the receipt. This personalizes the transaction and ensures that the receipt is correctly attributed to the individual who made the purchase.

Transaction Details

Detail the specifics of the transaction on the receipt, including the date of the purchase, the items or services bought, the quantity of each item, the unit price, the subtotal for each item, any applicable taxes or fees, and the total amount due. This breakdown provides a clear overview of the transaction for both parties.

Payment Method

Specify how the payment was made on the receipt, whether by cash, credit card, debit card, check, or other means. This information helps track payment methods and can be useful for reconciling transactions with financial records.

Terms and Conditions

Include any relevant terms and conditions on the receipt, such as return policies, warranties, disclaimers, or other important information. This ensures that both the business and the customer are aware of the terms associated with the transaction.

Signature and Stamp

If applicable, add a signature and stamp to the receipt to authenticate the transaction. This provides an extra layer of security and validation, particularly for high-value transactions or those that require additional verification.

How to Use Company Receipts Effectively

While issuing company receipts is essential, using them effectively can further enhance their value for both businesses and customers. By implementing best practices and strategies for receipt management, businesses can streamline their financial operations, improve customer satisfaction, and ensure compliance with legal requirements.

Organize Receipts

Keep receipts organized by date, category, or vendor to facilitate easy tracking and retrieval. This organizational approach makes it simpler to locate specific receipts when needed and can streamline the record-keeping process.

Scan and Store Digitally

Consider scanning and storing receipts digitally to reduce paper clutter and ensure that they are easily accessible. Digital storage options, such as cloud-based solutions or accounting software, offer a convenient and secure way to store receipts for future reference.

Track Expenses

Utilize receipts to track expenses and monitor spending patterns. By categorizing expenses and analyzing receipt data, businesses can gain insights into where their money is being spent and identify areas for cost savings or optimization.

Monitor Cash Flow

Regularly review receipts to monitor cash flow and assess the financial health of the business. Comparing receipts against income statements and budget projections can help identify discrepancies, spot trends, and make informed financial decisions.

Claim Deductions

Use receipts as supporting documentation to claim tax deductions and maximize savings. By retaining receipts for deductible expenses, businesses can reduce their taxable income and potentially lower their overall tax liability.

Review Terms and Conditions

Thoroughly review the terms and conditions on receipts to ensure compliance with any stipulations, such as return policies or warranties. This step helps prevent misunderstandings between the business and the customer and promotes a transparent and fair transaction process.

Tips for Maximizing the Benefits of Company Receipts

While company receipts are essential components of financial transactions, maximizing their benefits requires attention to detail and proactive receipt management strategies. By following these tips, businesses can optimize their use of receipts, improve financial transparency, and enhance customer satisfaction.

Keep a Digital Backup

It is advisable to maintain a digital backup of receipts to safeguard against loss or damage. Storing receipts in cloud-based solutions or digital filing systems ensures that they are easily retrievable and protected from physical wear and tear.

Separate Personal and Business Expenses

Keeping personal and business expenses separate by maintaining distinct sets of receipts simplifies accounting and tax filing processes. This practice helps businesses track their financial activities accurately and ensures compliance with regulatory requirements.

Regularly Reconcile Receipts

Regular reconciliation of receipts with bank statements and accounting records is essential for identifying discrepancies and maintaining financial accuracy. This practice helps businesses detect errors, fraud, or oversights in their financial records and ensures that all transactions are accounted for correctly.

Implement a Receipt Tracking System

Utilize receipt tracking software or apps to streamline the receipt management process. These tools can automate receipt capture, categorization, and analysis, making it easier to track expenses, monitor cash flow, and generate financial reports.

Train Employees on Receipt Procedures

Educate employees on proper receipt management procedures to ensure consistency and compliance with company policies. Training staff on the importance of accurate record-keeping, receipt retention, and data security promotes operational efficiency and minimizes errors in financial reporting.

Utilize Electronic Receipts

Consider offering electronic receipts as an eco-friendly and convenient alternative to paper receipts. Electronic receipts reduce paper waste, minimize storage space requirements, and provide customers with a digital record of their transactions for easy reference.

Retain Receipts for Audit Purposes

Maintain receipts for a specified period to comply with regulatory requirements and facilitate audits if necessary. Keeping organized records of receipts ensures that businesses have the necessary documentation to support their financial activities and transactions, allowing for a smooth audit process without delays or complications.

Review Receipts for Accuracy

Regularly review receipts for accuracy and completeness to ensure that all essential information is included. Checking receipts for errors, missing details, or discrepancies can help avoid confusion, improve financial transparency, and maintain the integrity of the transaction records.

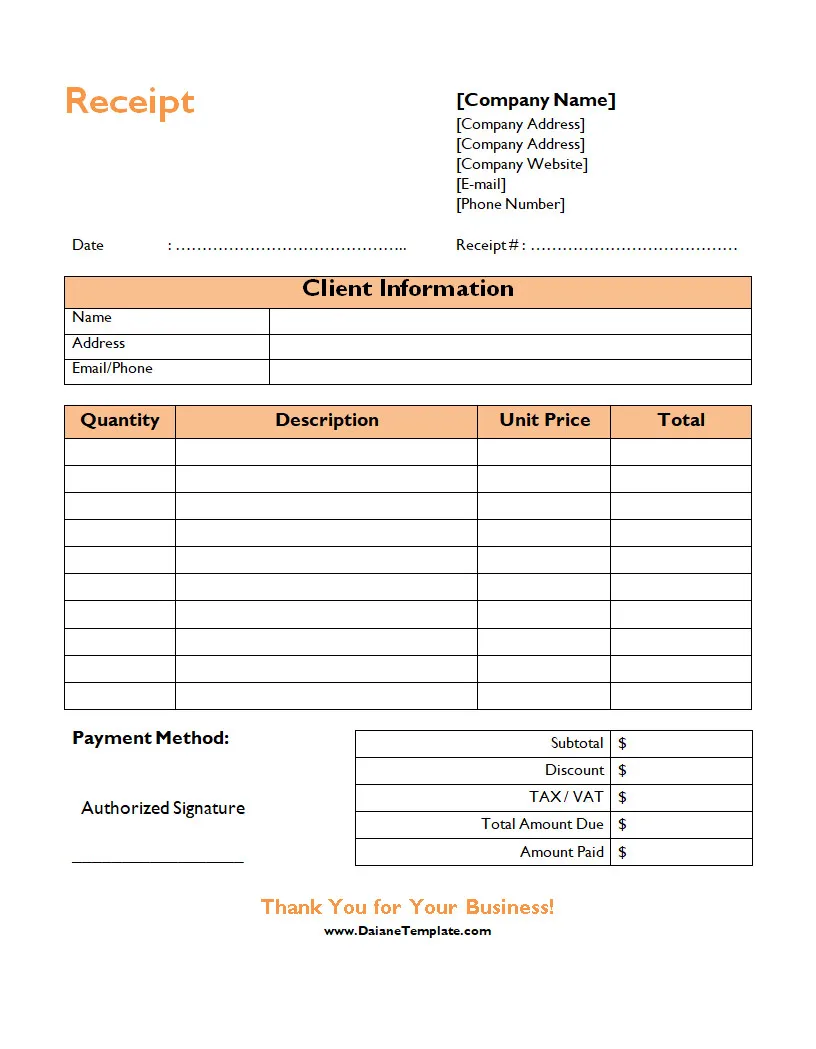

Company Receipt Template

A Company Receipt helps businesses provide clear, professional proof of transactions by outlining key details such as the payment amount, date, products or services provided, and contact information. It ensures accurate recordkeeping, supports transparency with customers, and maintains a consistent format across all receipts. With a ready-to-use template, you can streamline your documentation process and present polished, reliable receipts every time.

Download our Company Receipt Template today to simplify your recordkeeping and issue professional receipts with ease.

Company Receipt Template – WORD