In today’s fast-paced world, daycare services have become a necessity for many working parents. Daycare receipts serve as a crucial piece of documentation, providing proof of payment for childcare services and ensuring transparency between parents and providers.

This guide will delve into the intricacies of daycare receipts, exploring their importance, different types available, what information is needed for tax purposes, how to create them, best practices, and more.

What is a Daycare Receipt?

A daycare receipt is a formal document issued by childcare providers to parents or guardians as proof of payment for daycare services. It typically includes key details such as the daycare facility’s name and address, the amount paid, service dates, and any additional charges. More than just a payment record, a daycare receipt serves as a clear, traceable record of the transaction.

From a legal standpoint, daycare receipts are important because they provide verifiable proof of payment. In the event of a dispute or discrepancy, a detailed receipt can help resolve issues quickly and fairly. Maintaining accurate, consistent records benefits both providers and parents by offering protection and promoting transparency.

The Importance of Daycare Receipts

1. Ensuring Financial Transparency

Financial transparency is crucial in any business transaction, including childcare services. Daycare receipts play a pivotal role in ensuring transparency by clearly documenting payment details, service agreements, and any additional charges. By providing a transparent breakdown of expenses, daycare receipts help parents understand the value they receive for their money.

2. Protecting Parents and Providers

Daycare receipts offer protection for both parents and providers by serving as a formal record of financial transactions. In the event of a dispute or misunderstanding, a well-documented receipt can provide clarity and evidence to resolve the issue. By maintaining detailed records through receipts, parents and providers can protect themselves legally and financially.

3. Facilitating Tax Compliance

One of the essential functions of daycare receipts is facilitating tax compliance for parents. Childcare expenses may be eligible for tax deductions or credits, but proper documentation is required to claim these benefits. Daycare receipts provide the necessary proof of payment and services rendered, allowing parents to accurately report childcare expenses on their tax returns.

4. Supporting Reimbursement Claims

In some cases, parents may be eligible for reimbursement of childcare expenses from their employers or government programs. Daycare receipts serve as crucial documentation to support these reimbursement claims by providing evidence of payment and services received. By maintaining organized receipts, parents can confidently seek reimbursement for childcare costs.

5. Building Trust and Professionalism

Daycare receipts are not just about financial transactions; they also play a role in building trust and professionalism between parents and providers. By issuing clear and detailed receipts, providers demonstrate their commitment to transparency and accountability. This professionalism fosters trust and confidence in the childcare arrangement, benefiting both parties.

What’s Needed on a Child Care Receipt for Tax Purposes?

When it comes to tax purposes, daycare receipts must include specific information to ensure compliance with tax regulations and facilitate accurate reporting of childcare expenses. Understanding what is needed on a child care receipt for tax purposes can help parents maximize their tax benefits and avoid any issues with the IRS.

1. Provider Information

One of the essential components of a daycare receipt for tax purposes is detailed provider information. This includes the name, address, and contact information of the daycare facility or individual provider. The IRS requires this information to verify the legitimacy of the childcare services and ensure that the expenses are eligible for tax deductions.

2. Parent Information

In addition to provider information, daycare receipts must include detailed parent information for tax purposes. This includes the name, address, and contact information of the parent or guardian who paid for the childcare services. Including parent information on the receipt helps tie the expenses to the individual claiming the deduction on their tax return.

3. Payment Details

Payment details are a crucial part of daycare receipts for tax purposes, as they provide a clear record of the financial transactions. The receipt should include the amount paid, dates of service, and any additional charges or fees incurred. These details help substantiate the childcare expenses claimed on the tax return and ensure accurate reporting to the IRS.

4. Tax Identification Number

To comply with tax regulations, daycare receipts must include the provider’s tax identification number (TIN) or employer identification number (EIN). This unique identifier helps the IRS verify the provider’s tax status and ensures that the childcare expenses are associated with a legitimate business entity. Including the TIN or EIN on the receipt is essential for tax compliance.

5. Signature

A signed acknowledgment on the daycare receipt is essential for tax purposes, as it confirms the validity of the document. Both the provider and the parent should sign the receipt to acknowledge the payment and services rendered. The signature serves as a form of verification and helps validate the childcare expenses claimed on the tax return.

6. Date Issued

The date on which the daycare receipt is issued is a critical piece of information for tax purposes. Including the date on the receipt helps establish the timeline of the financial transaction and ensures accurate record-keeping. Parents should retain receipts with the issue date for tax documentation and reference when filing their tax return.

7. Tax Deduction Information

Daycare receipts for tax purposes may include specific information related to tax deductions or reimbursements. Providers can include details such as the total amount paid for childcare services, any applicable credits or deductions, and any other relevant tax information. This information helps parents accurately report childcare expenses on their tax return and maximize their tax benefits.

Creating a Daycare Receipt

Creating a daycare receipt is a straightforward process that requires attention to detail and accuracy. Providers can use templates, software, or online platforms to generate customized receipts that meet the specific needs of parents and comply with tax regulations. By following best practices and including essential information, providers can create professional and effective daycare receipts.

1. Customizing Receipt Templates

Providers can streamline the process of creating daycare receipts by using customizable templates. These templates typically include fields for provider information, parent information, payment details, and any additional notes. By customizing the template to include specific information relevant to the services provided, providers can create professional-looking receipts that are tailored to their business.

2. Using Digital Tools

Digital tools and software can simplify the process of creating daycare receipts and ensure accuracy and consistency. Providers can use online platforms that offer customizable receipt templates, automated calculations, and digital signatures. These tools make it easy to generate receipts quickly, store them electronically, and access them when needed for tax purposes

3. Ensuring Accuracy and Clarity

When creating daycare receipts, providers must ensure accuracy and clarity in the information provided. Double-checking payment details, dates of service, and any additional charges is essential to avoid errors or discrepancies. Clear and concise language should be used to communicate payment terms and service descriptions effectively to parents.

4. Including Necessary Details

Daycare receipts should include all necessary details to provide a comprehensive record of the financial transaction. In addition to basic information like provider and parent details, payment amounts, and dates of service, providers may choose to include additional information such as service descriptions, payment methods, and any policies or disclaimers. Including all relevant details ensures that the receipt is informative and comprehensive.

5. Professional Presentation

The presentation of daycare receipts is important for creating a positive impression on parents and maintaining professionalism. Providers should ensure that receipts are well-formatted, legible, and free from errors. Using professional design elements, such as a logo or branding, can enhance the visual appeal of the receipt and reinforce the provider’s credibility.

6. Issuing Receipts Promptly

Issuing daycare receipts promptly after payment is essential to maintain accurate record-keeping and transparency. Parents rely on receipts to track their expenses and may need them for tax purposes or reimbursement claims. By providing receipts on time, providers demonstrate their commitment to professionalism and customer service.

Best Practices for Daycare Receipts

Following best practices when creating and issuing daycare receipts can help providers streamline their operations, maintain compliance with regulations, and ensure a positive experience for parents.

1. Be Clear and Detailed

Clarity and detail are essential when creating daycare receipts. Include all relevant information, such as payment amounts, dates of service, and any additional charges. Clearly outline the terms of the agreement and provide a breakdown of services rendered to ensure transparency and avoid misunderstandings.

2. Use Professional Templates

Utilizing professional templates for daycare receipts can help providers maintain consistency and professionalism in their documentation. Templates offer a standardized format for receipts, making it easy to include all necessary information and present it in a clear and organized manner. Providers can customize templates to include specific details relevant to their services.

3. Keep Records Organized

Maintaining organized records of daycare receipts is crucial for efficient record-keeping and compliance with regulations. Providers should establish a system for storing and organizing receipts, whether in physical or digital format. Keeping receipts organized by date, client, or payment method can streamline financial management and facilitate easy access to documentation when needed.

4. Stay Up-to-Date with Regulations

Staying informed about tax laws, regulations, and industry standards is essential for providers issuing daycare receipts. Regulations related to childcare expenses, tax deductions, and documentation requirements may change over time. Providers should regularly review and update their practices to ensure compliance with current regulations and avoid any legal issues.

5. Communicate Effectively with Parents

Effective communication with parents about the importance of daycare receipts can help build trust and transparency in the childcare arrangement. Providers should explain the purpose of receipts, how they can be used for tax purposes, and any other relevant information. Addressing parents’ questions or concerns about receipts demonstrates a commitment to open communication.

6. Seek Professional Advice

Providers who are unsure about tax deductions, compliance requirements, or other financial matters related to daycare receipts should seek professional advice. Consulting with a tax professional, accountant, or legal advisor can provide valuable guidance on best practices for record-keeping, tax compliance, and financial management. Professional advice can help providers navigate complex financial issues with confidence.

7. Stay Proactive

Proactivity is key when it comes to issuing daycare receipts and maintaining accurate financial records. Providers should be proactive in issuing receipts promptly after payment, ensuring that all necessary information is included, and keeping records organized. By staying on top of documentation and record-keeping, providers can avoid mistakes and maintain a professional standard of service.

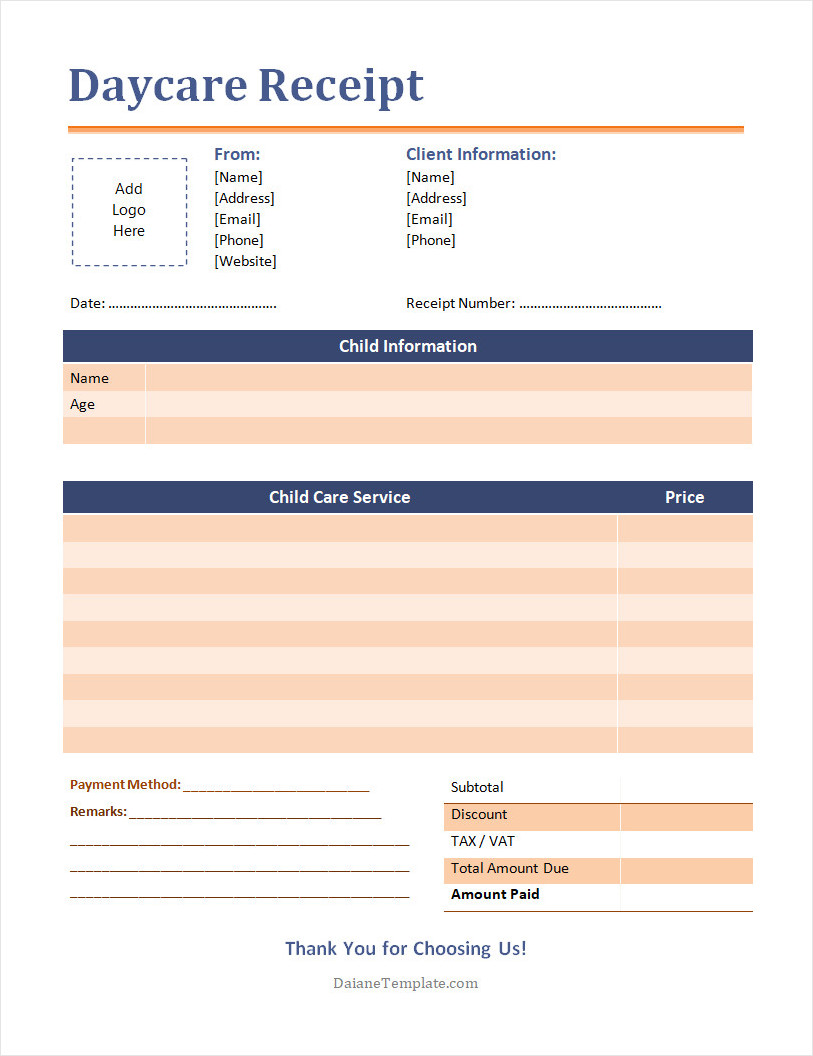

Daycare Receipt Template

Providing clear and consistent receipts is essential for maintaining trust and transparency between daycare providers and parents. A well-structured daycare receipt not only documents payments but also helps with financial tracking, tax reporting, and recordkeeping for both parties.

Download our free daycare receipt template today to simplify your billing process and keep accurate records. Easy to customize, print-ready, and ideal for home daycares, childcare centers, and after-school programs.

Daycare Receipt Template – Word