Debt collection letters are an essential tool for businesses and creditors in the accounts receivable process. These formal communications serve as a pivotal step in recovering outstanding debts, ensuring that debtors are reminded of their financial obligations and the consequences of non-payment.

By sending debt collection letters, creditors can establish a clear paper trail of their collection efforts and demonstrate to debtors that they are serious about recouping the money owed to them.

What is a Debt Collection Letter?

A debt collection letter is a written document sent by a creditor or a collection agency to a debtor, requesting payment for an overdue debt. These letters typically outline the details of the debt, including the total amount owed, any interest or fees that have accumulated, and the due date by which the payment must be made.

Debt collection letters also inform debtors of the potential repercussions of non-payment, such as negative impacts on their credit score or legal action.

Why Are Debt Collection Letters Important?

Debt collection letters play a crucial role in the accounts receivable process for several reasons. Firstly, they serve as a formal record of the collection attempt, providing evidence that the creditor has made a concerted effort to recover the debt. This documentation can be invaluable in legal proceedings or disputes over the debt.

Protecting Creditors’ Rights

Moreover, debt collection letters help to protect the rights of creditors by clearly outlining the terms of the debt and the consequences of non-payment. By informing debtors of these repercussions upfront, creditors can establish clear expectations and boundaries for debt repayment.

Encouraging Timely Payment

Debt collection letters also serve to encourage debtors to make timely payments on their outstanding debts. By clearly communicating the amount owed, the due date, and any additional charges that may apply, these letters help debtors understand the urgency of the situation and prompt them to take action.

What to Include in a Debt Collection Letter?

When composing a debt collection letter, it is essential to include specific information to ensure its effectiveness in prompting debtors to pay their debts. The key elements to include in a debt collection letter are:

Details of the Debt

The debt collection letter should clearly state the total amount owed by the debtor, including any interest or fees that have accrued since the debt became overdue. Providing a breakdown of the debt helps debtors understand the full extent of their financial obligations.

Consequences of Non-Payment

It is crucial to outline the potential consequences of failing to pay the debt in the debt collection letter. This can include mentioning the impact on the debtor’s credit score, the possibility of legal action being taken, or the involvement of a collection agency to recover the debt.

Payment Options

The debt collection letter should provide detailed information on payment options available to the debtor. This can include specifying acceptable payment methods, such as online payment portals, checks, or wire transfers, and providing instructions on where to send the payment.

Contact Information

Including contact information for the creditor or collection agency in the debt collection letter is vital. Debtors may have questions or require assistance with making payments, and having clear contact details ensures that they can easily reach out for support.

Deadline for Payment

Setting a clear deadline for the debtor to respond or make payment is essential in a debt collection letter. By specifying a deadline, creditors create a sense of urgency and prompt debtors to take immediate action to settle their debts.

How to Write an Effective Debt Collection Letter

Crafting an effective debt collection letter requires careful attention to detail and a strategic approach to communication. Here are some tips for writing an impactful debt collection letter that encourages debtors to pay their outstanding debts:

Be Clear and Concise

When writing a debt collection letter, clarity is key. Use straightforward language and concise sentences to clearly communicate the purpose of the letter and the amount owed by the debtor. Avoid using jargon or complex terms that may confuse the recipient.

Maintain Professionalism

It is essential to maintain a professional tone throughout the debt collection letter. While it is crucial to convey the seriousness of the situation, it is equally important to remain respectful and courteous in your communication with the debtor. Avoid using aggressive or threatening language that may escalate the situation.

Provide Detailed Information

Include all relevant details about the debt in the collection letter, such as the total amount owed, the due date, any additional fees or interest charges, and the consequences of non-payment. By providing comprehensive information, you help debtors understand the urgency of the situation and what is required of them.

Set Clear Expectations

Clearly outline the expectations for the debtor in terms of payment deadlines and consequences of non-compliance. By setting clear expectations, you make it easier for debtors to understand what is required of them and what will happen if they do not meet their obligations.

Follow Up Appropriately

If the debtor does not respond to the initial debt collection letter, consider sending a follow-up communication. Follow-up letters can serve as a gentle reminder to debtors and prompt them to take action before more aggressive collection measures are taken.

Provide Assistance

Offer assistance to debtors who may have questions or concerns about their debt or payment options. Providing clear contact information and being available to address any issues can help facilitate the debt repayment process and improve communication between creditors and debtors.

Remain Persistent

Persistence is key in debt collection. If debtors do not respond to initial collection efforts, continue to follow up with additional letters or phone calls to prompt them to address their outstanding debts. By staying persistent, creditors increase their chances of recovering the money owed to them.

Tips for Successful Debt Collection Letters

When sending debt collection letters, there are several tips to keep in mind to maximize their effectiveness in recovering outstanding debts. Here are some key tips for successful debt collection letters:

1. Personalize the Letter

Personalizing debt collection letters can help create a more human connection with the debtor and increase the likelihood of a response. Address the debtor by name and tailor the content of the letter to their specific situation for a more personalized touch.

2. Clearly Outline the Debt

Provide a detailed breakdown of the debt, including the total amount owed, any interest or fees, and the original due date. By offering a clear picture of the debt, debtors are more likely to understand their financial obligations and take action to resolve them.

3. Offer Payment Options

Give debtors multiple payment options to make it easier for them to settle their debts. Whether it’s through online payment portals, checks, or payment plans, providing flexibility in payment methods can encourage debtors to take action and make a payment.

4. Emphasize the Consequences of Non-Payment

Clearly communicate the consequences of failing to pay the debt in the debt collection letter. Whether it’s impacting their credit score, facing legal action, or incurring additional fees, outlining the repercussions can motivate debtors to prioritize settling their debts.

5. Be Persistent but Polite

Persistence is essential in debt collection, but it’s equally important to remain polite and professional in your communications. Avoid using aggressive language or tactics that may alienate debtors and instead maintain a respectful tone throughout the collection process.

6. Keep Accurate Records

Maintain accurate records of all communications with debtors, including copies of debt collection letters, phone call logs, and any responses received. These records can be valuable evidence in case of legal disputes or if further collection action is necessary.

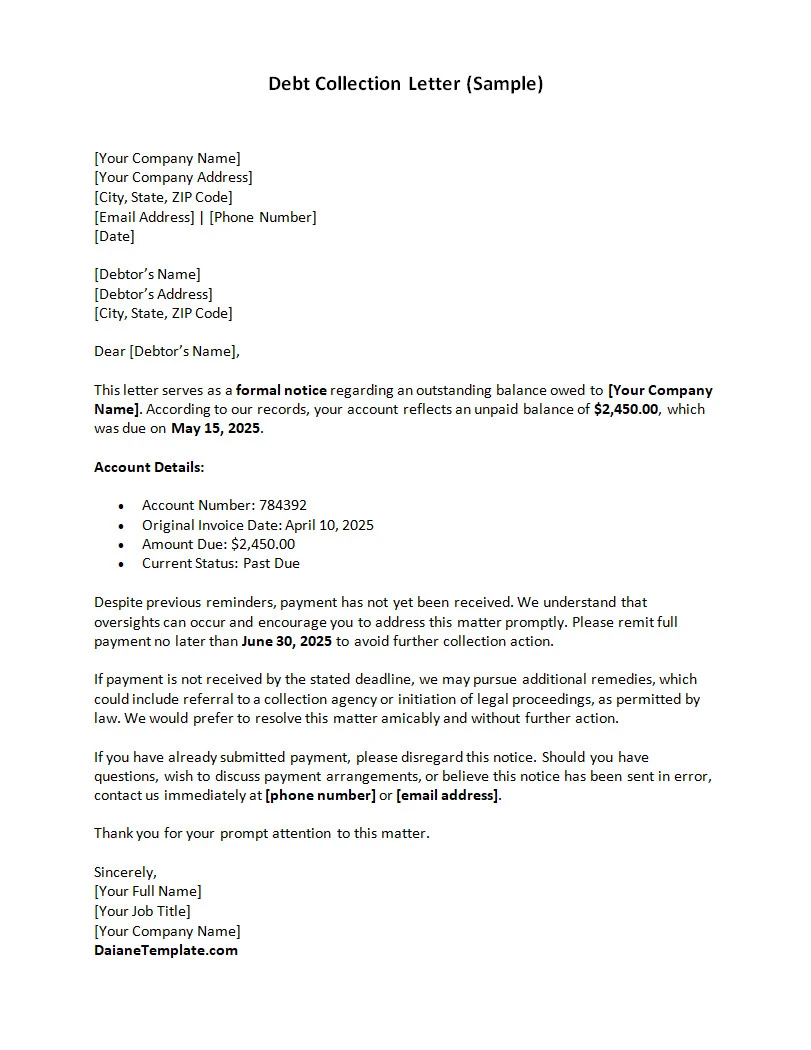

Debt Collection Letter Template

A Debt Collection Letter helps you request outstanding payments in a clear, professional, and legally appropriate manner. It provides a structured format for stating the amount due, payment deadline, and next steps while maintaining a respectful tone that supports resolution. With a well-prepared template, you can improve communication, protect your rights, and encourage timely payment.

Download our Debt Collection Letter Template today to pursue overdue payments clearly and confidently.

Debt Collection Letter Template – DOWNLOAD