What is a Company Budget?

A company budget is a financial plan that outlines projected revenues and expenses for a specific period, typically a fiscal year. It serves as a roadmap for the management of financial resources and the achievement of business objectives.

A well-structured budget provides a clear overview of the company’s financial health and guides decision-making processes.

Why is Company Budgeting Important?

Financial Stability

One of the key reasons why company budgeting is important is to maintain financial stability. By creating a budget that aligns expenses with revenues, businesses can avoid cash flow shortages and financial distress. A well-managed budget ensures that resources are allocated efficiently, debts are managed effectively, and financial risks are minimized.

Goal Achievement

Budgeting plays a crucial role in helping businesses set and achieve financial goals. By outlining clear objectives and allocating resources accordingly, companies can track progress towards their targets and make necessary adjustments to stay on course. Budgets provide a roadmap for growth, expansion, and profitability by ensuring that resources are utilized in a strategic manner.

Decision-Making

Effective budgeting provides businesses with valuable insights for informed decision-making. By analyzing budget variances, identifying cost-saving opportunities, and prioritizing investments, companies can make strategic decisions that align with their financial objectives. Budgets help businesses optimize resource allocation, minimize risks, and capitalize on growth opportunities in a competitive market.

Performance Evaluation

Budgets serve as a tool for evaluating performance against planned targets. By comparing actual financial results with budgeted projections, businesses can identify strengths, weaknesses, and areas for improvement. Performance evaluations help businesses assess their financial health, measure progress towards goals, and make data-driven decisions to enhance overall performance and profitability.

What to Include in a Company Budget?

Revenue Projections

Revenue projections are an essential component of a company’s budget as they estimate the income expected from sales, services, and other revenue streams. Businesses must accurately forecast revenues based on market trends, customer demand, and historical data to ensure realistic budget projections and financial stability. Revenue projections provide a foundation for budgeting expenses, setting targets, and measuring financial performance.

Expense Forecasts

Expense forecasts detail the costs associated with running a business, including fixed expenses such as rent, salaries, and utilities, as well as variable expenses like supplies, marketing, and maintenance. By forecasting expenses accurately, businesses can plan for cash outflows, control spending, and prioritize expenditures based on strategic priorities. Expense forecasts help businesses manage costs, allocate resources effectively, and optimize budget performance.

Cash Flow Analysis

Cash flow analysis is a critical aspect of company budgeting as it monitors the inflow and outflow of cash within a business. By tracking cash flow trends, businesses can ensure that they have sufficient liquidity to meet operational needs, pay bills on time, and weather financial challenges. Cash flow analysis helps businesses manage working capital, optimize cash flow cycles, and make informed decisions to improve financial health and stability.

Capital Expenditures

Capital expenditures are long-term investments in assets such as equipment, technology, facilities, or infrastructure that provide future economic benefits to a business. Including capital expenditures in the budget allows companies to plan for large-scale investments, allocate funds strategically, and prioritize projects that support growth and innovation. Capital expenditure planning ensures that businesses have the necessary resources to expand operations, enhance productivity, and stay competitive in the market.

Contingency Fund

A contingency fund is a reserve set aside in the budget to cover unexpected expenses or emergencies that may arise during the year. By including a contingency fund, businesses can mitigate financial risks, address unforeseen challenges, and maintain financial stability in times of uncertainty. Contingency funds provide a cushion for cash flow disruptions, market fluctuations, or unforeseen events that could impact the company’s financial health.

How to Create an Effective Company Budget?

Set Clear Financial Goals

Setting clear financial goals is the first step in creating an effective company budget. Businesses must define their objectives, identify key performance indicators, and establish measurable targets for revenue growth, cost reduction, profitability, and cash flow management. Clear financial goals provide the foundation for budgeting decisions, resource allocation, and performance tracking throughout the fiscal year.

Gather Financial Data

Gathering accurate and up-to-date financial data is essential for creating a realistic company budget. Businesses should analyze historical performance, market trends, industry benchmarks, and economic forecasts to inform budget projections and assumptions. By leveraging financial data effectively, companies can make informed decisions, identify trends, and anticipate changes that may impact their financial health and performance.

Allocate Resources Wisely

Allocating resources wisely is a key aspect of effective budgeting. Businesses must prioritize spending based on revenue priorities, operational needs, strategic initiatives, and potential return on investment. By aligning resource allocation with business objectives, companies can optimize budget performance, minimize waste, and enhance profitability. Wise resource allocation ensures that funds are directed towards activities that drive growth, innovation, and competitive advantage.

Monitor and Adjust

Regularly monitoring budget performance and making necessary adjustments is crucial for maintaining an effective company budget. Businesses should track actual financial results against budgeted projections, identify variances, and analyze the root causes of discrepancies. By monitoring budget performance in real-time, companies can proactively address issues, make timely decisions, and adapt to changing market conditions. Continuous monitoring and adjustment ensure that budgets remain on track, goals are met, and financial health is maintained.

Communicate and Collaborate

Effective communication and collaboration are essential for successful company budgeting. Businesses should involve key stakeholders, such as department heads, finance teams, and senior management, in the budgeting process to gain buy-in, align priorities, and foster a culture of financial accountability. By communicating budget goals, expectations, and performance metrics clearly, companies can ensure that all stakeholders are informed, engaged, and committed to achieving financial objectives.

Tips for Successful Company Budgeting

Be Realistic

When creating a company budget, it is important to be realistic in setting goals and making projections. Avoid overestimating revenues, underestimating expenses, or setting unattainable targets that may lead to budgetary challenges. By basing budget projections on accurate data, market trends, and realistic assumptions, businesses can create a budget that is achievable, actionable, and aligned with their financial objectives.

Plan for Contingencies

Incorporating contingencies into the budget is essential for handling unexpected expenses or revenue fluctuations. Businesses should set aside a reserve fund to cover unforeseen costs, emergencies, or market uncertainties that may impact financial performance. Planning for contingencies helps companies mitigate risks, maintain financial stability, and respond effectively to unforeseen events that could disrupt budget projections.

Review Regularly

Regularly reviewing budget performance and analyzing variances is critical for successful company budgeting. Businesses should track actual results against budgeted projections, identify discrepancies, and analyze the reasons for deviations. By conducting regular reviews, companies can proactively address issues, make informed decisions, and adjust budgets as needed to stay on track. Continuous monitoring ensures that budgets remain accurate, goals are achieved, and financial health is optimized.

Seek Professional Guidance

Seeking professional guidance from financial experts or consultants can enhance the effectiveness of company budgeting efforts. Experienced professionals can provide valuable insights, best practices, and industry knowledge to help businesses develop a robust budgeting strategy tailored to their specific needs. By leveraging external expertise, companies can gain a fresh perspective, identify opportunities for improvement, and optimize budget performance for long-term success.

Invest in Financial Tools

Investing in financial tools such as accounting software, budgeting apps, or financial management systems can streamline the budgeting process and enhance accuracy. Technology solutions enable businesses to automate budgeting tasks, track financial data in real-time, and generate reports for analysis and decision-making. By leveraging financial tools, companies can improve efficiency, reduce errors, and facilitate collaboration across departments to ensure that budgets are well-managed and optimized for success.

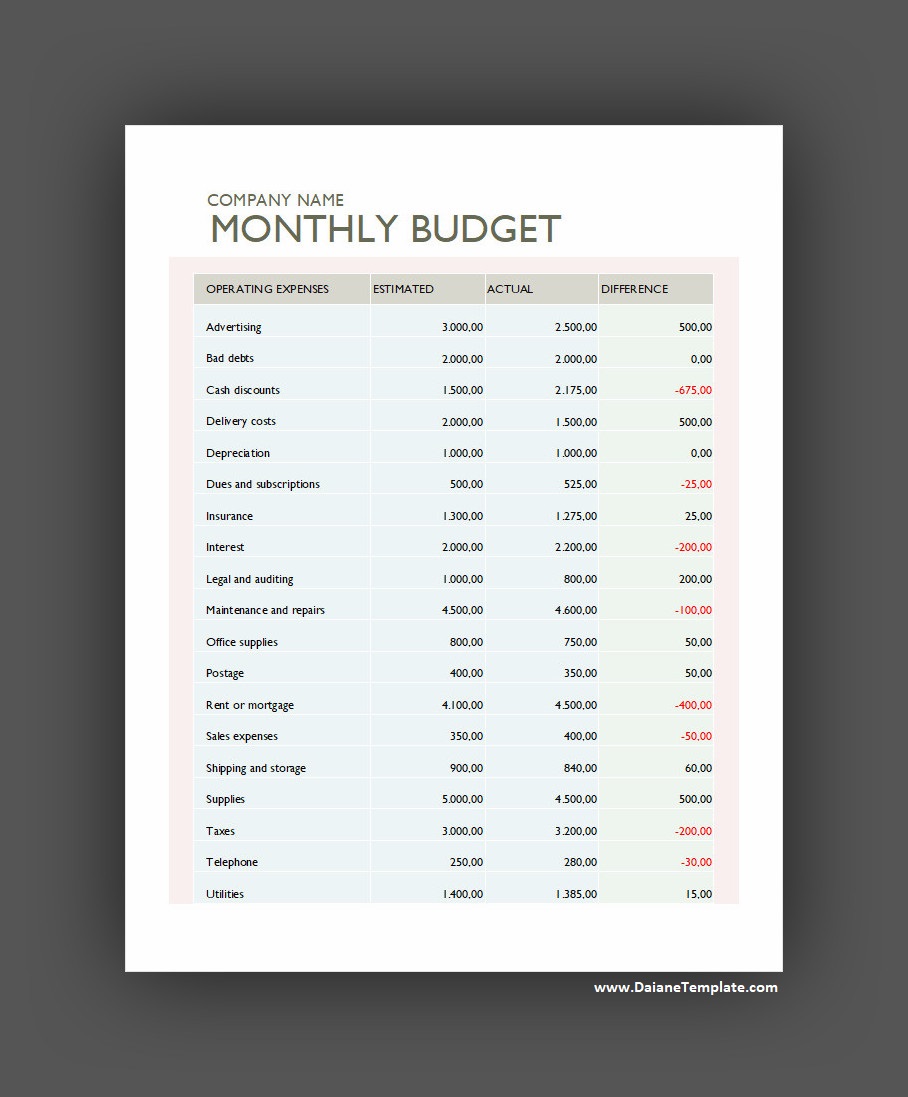

Company Budget Template

A company budget helps you plan expenses, track income, and allocate resources effectively to achieve business goals. It provides financial clarity and supports smarter decision-making.

Download our free Company Budget Template today and start managing your business finances with confidence.

Company Budget Template – Excel