In the world of business and project management, making informed decisions is crucial for success. One of the tools that organizations use to make data-driven decisions is cost-benefit analysis (CBA).

CBA is a systematic approach to evaluating the costs and benefits of a project or decision to determine if the expected benefits outweigh the costs. By comparing the total monetary costs and benefits, organizations can gain valuable insights into the potential value of an initiative, optimize resource allocation, and select the most beneficial course of action to drive profitability and long-term success.

What Is a Cost-Benefit Analysis?

Cost-Benefit Analysis (CBA) is a technique used by organizations to evaluate the potential costs and benefits of a project or decision. It is a systematic process that involves identifying, quantifying, and comparing the expected costs and benefits of a particular course of action.

By analyzing the financial implications of a decision, CBA helps organizations make informed choices that align with their strategic objectives and financial goals.

Why Might a Company Perform a Cost-Benefit Analysis?

There are several reasons why a company might choose to perform a Cost-Benefit Analysis. Some of the key motivations include:

Resource Allocation

One of the primary reasons for conducting a CBA is to optimize the allocation of resources within an organization. By evaluating the costs and benefits of different projects or initiatives, organizations can identify those that offer the highest return on investment and allocate resources accordingly. CBA helps organizations prioritize projects based on their potential for profitability, ensuring that resources are used effectively to drive business success.

Profitability

Cost-Benefit Analysis is also crucial for assessing the potential profitability of a project or decision. By quantifying the expected costs and benefits in monetary terms, organizations can determine whether the anticipated returns justify the investment. CBA helps organizations make strategic decisions that align with their financial goals and drive profitability over the long term.

Risk Management

Another key reason for performing a CBA is to assess and mitigate risks associated with a project. By evaluating the potential costs and benefits, organizations can identify potential risks and uncertainties that may impact the success of a project. CBA enables organizations to make informed decisions about risk management strategies and develop contingency plans to address unforeseen challenges.

Decision-Making

Cost-Benefit Analysis provides organizations with a systematic framework for making data-driven decisions. By quantifying the costs and benefits of a project, CBA helps organizations evaluate the financial implications of different courses of action and make informed choices that align with their strategic objectives. CBA enables organizations to prioritize projects based on their potential for financial success, driving profitability and long-term growth.

Key Components of a Cost-Benefit Analysis

The key components of a Cost-Benefit Analysis include:

Identification of Costs and Benefits

The first step in conducting a CBA is to identify all potential costs and benefits associated with a project or decision. Costs may include direct expenses, such as materials and labor, as well as indirect costs, such as opportunity costs or externalities. Benefits can include revenue generation, cost savings, and other positive outcomes resulting from the project.

Quantification of Costs and Benefits

Once the costs and benefits have been identified, they need to be quantified in monetary terms to enable comparison. This involves assigning a dollar value to each cost and benefit, taking into account factors such as inflation, discount rates, and time horizons. Quantification allows organizations to measure the financial impact of a decision and determine whether the benefits outweigh the costs.

Discounting and Sensitivity Analysis

Cost-Benefit Analysis often involves discounting future costs and benefits to account for the time value of money. Discounting adjusts the value of future cash flows to reflect their present value, taking into account factors such as inflation and interest rates. Additionally, sensitivity analysis is used to assess the impact of uncertainties on the results of the CBA, helping organizations understand the potential risks and variability of the analysis.

Cost-Benefit Ratio Calculation

The cost-benefit ratio is a key metric used in CBA to determine whether the benefits of a project outweigh the costs. It is calculated by dividing the total benefits of a project by the total costs, resulting in a ratio that indicates the efficiency and profitability of the project. A cost-benefit ratio greater than one indicates that the benefits outweigh the costs, while a ratio less than one suggests that the costs exceed the benefits.

Decision-Making

Based on the results of the CBA, organizations can make informed decisions about whether to proceed with a project, modify it, or abandon it. The insights gained from the analysis help organizations prioritize projects based on their potential for financial success and allocate resources effectively. CBA enables organizations to make data-driven decisions that align with their strategic objectives and drive profitability over the long term.

Process of Conducting a Cost-Benefit Analysis

The process of conducting a Cost-Benefit Analysis typically involves the following steps:

Define the Project

The first step in conducting a CBA is to clearly define the project or decision that is being evaluated. This involves establishing the objectives and goals of the project, as well as identifying the scope and timeline of the analysis. Defining the project ensures that the analysis is focused and aligns with the organization’s strategic priorities.

Identify Costs and Benefits

Once the project has been defined, the next step is to identify all potential costs and benefits associated with the project. Costs may include direct expenses, such as materials and labor, as well as indirect costs, such as opportunity costs or externalities. Benefits can include revenue generation, cost savings, and other positive outcomes resulting from the project.

Quantify Costs and Benefits

After identifying the costs and benefits, they need to be quantified in monetary terms to enable comparison. This involves assigning a dollar value to each cost and benefit, taking into account factors such as inflation, discount rates, and time horizons. Quantification allows organizations to measure the financial impact of a decision and determine whether the benefits outweigh the costs.

Discount Future Costs and Benefits

Cost-Benefit Analysis often involves discounting future costs and benefits to account for the time value of money. Discounting adjusts the value of future cash flows to reflect their present value, taking into account factors such as inflation and interest rates. By discounting future costs and benefits, organizations can assess the financial implications of a decision over time and make informed choices about resource allocation.

Calculate the Cost-Benefit Ratio

Once the costs and benefits have been quantified, the next step is to calculate the cost-benefit ratio. This is done by dividing the total benefits of a project by the total costs, resulting in a ratio that indicates the efficiency and profitability of the project. A cost-benefit ratio greater than one suggests that the benefits outweigh the costs, while a ratio less than one indicates that the costs exceed the benefits.

Make a Decision

Based on the results of the CBA, organizations can make an informed decision about whether to proceed with the project, modify it, or abandon it. The insights gained from the analysis help organizations prioritize projects based on their potential for financial success and allocate resources effectively. By incorporating CBA into decision-making processes, organizations can make data-driven choices that align with their strategic objectives and drive profitability over the long term.

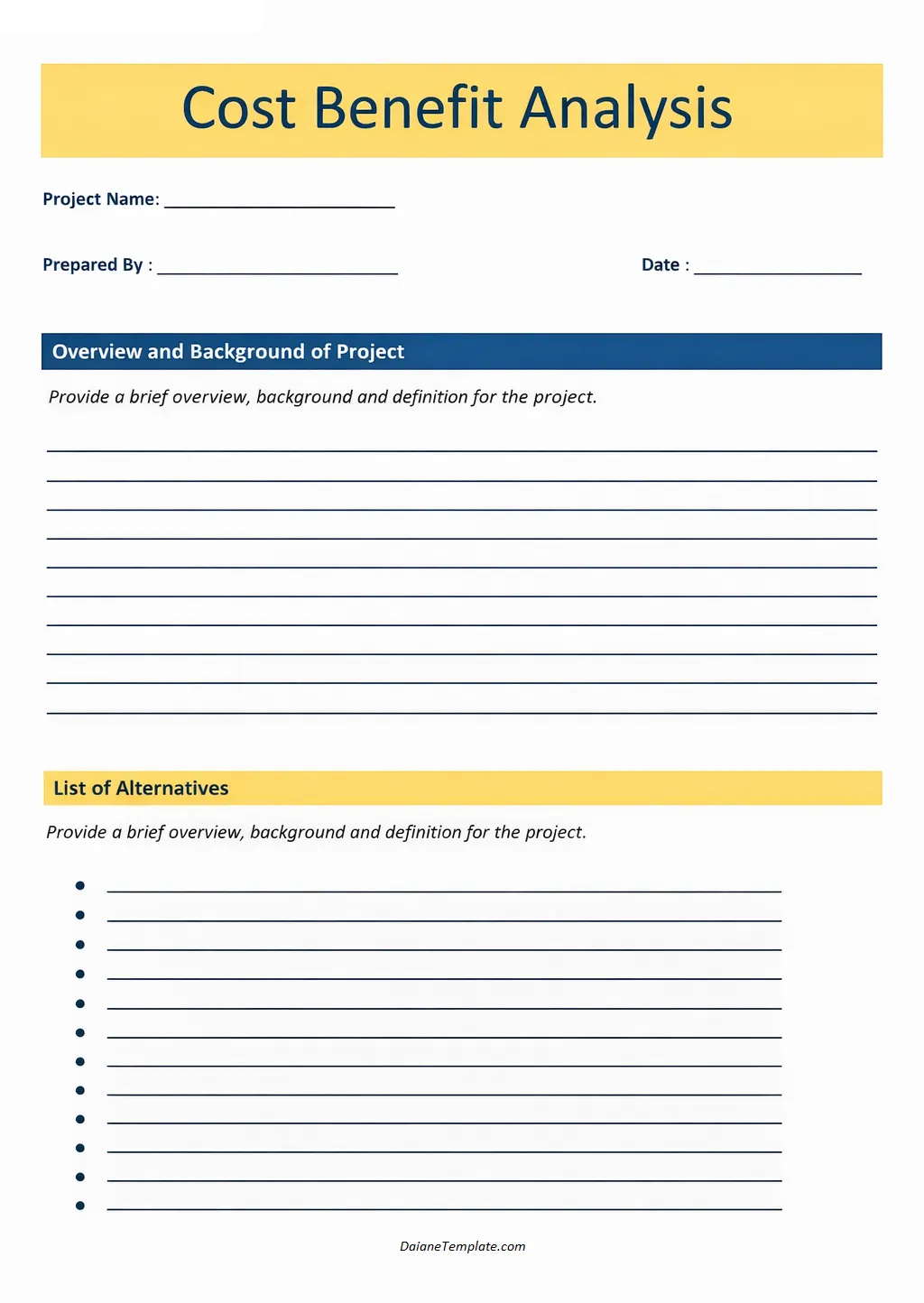

Cost-Benefit Analysis Template – EXCEL