Applying for a credit card can be an exciting but somewhat daunting process. One of the essential steps in this process is filling out a credit card application form. This form collects crucial personal, financial, and employment information from you, the applicant, so that the credit card issuer can assess your creditworthiness.

The issuer uses this information to determine whether to approve your credit card application, set a credit limit, and establish favorable terms. Understanding the ins and outs of a credit card application form is key to a successful application process.

What is a Credit Card Application Form?

A credit card application form is a standardized document that collects information from individuals seeking to apply for a credit card. This form is typically provided by the credit card issuer and serves as a tool for gathering important details about the applicant’s financial situation, employment status, and credit history.

By completing the credit card application form, applicants provide the necessary information for the issuer to evaluate their creditworthiness and make an informed decision about extending credit.

Why are Credit Card Application Forms Important?

Credit card application forms play a crucial role in the credit card approval process. They serve as a means for the issuer to gather detailed information about the applicant’s financial health, credit history, and ability to manage credit responsibly. By analyzing the information provided on the application form, the issuer can assess the risk associated with extending credit to the applicant and determine the appropriate credit limit and terms. Credit card application forms help ensure that both parties enter into a clear and legally binding agreement regarding the use of the credit card.

Evaluating Creditworthiness

One of the primary purposes of a credit card application form is to help the issuer evaluate the applicant’s creditworthiness. By providing information about their income, expenses, debts, and credit history, applicants give the issuer a comprehensive view of their financial situation. This information allows the issuer to assess the applicant’s ability to manage credit responsibly and make timely payments. The issuer uses this assessment to determine whether to approve the credit card application and set appropriate terms and conditions.

Determining Credit Limit

Another important aspect of a credit card application form is its role in determining the credit limit for the applicant. The credit limit is the maximum amount of money that the cardholder can borrow on the credit card. By evaluating the applicant’s financial information provided on the application form, the issuer can determine a suitable credit limit that aligns with the applicant’s income and ability to repay. The credit limit set by the issuer influences the purchasing power of the cardholder and helps prevent excessive borrowing beyond their means.

Establishing Legal Agreement

When an individual completes a credit card application form and submits it to the issuer, they are essentially entering into a legal agreement regarding the use of the credit card. The information provided on the application form, along with the terms and conditions outlined by the issuer, form the basis of this agreement. By signing the application form, the applicant acknowledges that they have read and understood the terms and conditions of the credit card and agree to abide by them. This legal agreement helps protect both the applicant and the issuer by establishing clear expectations and responsibilities.

Compliance with Lending Laws

Credit card application forms also play a crucial role in ensuring that the issuer complies with relevant lending laws and regulations. These laws are designed to protect consumers from unfair lending practices and ensure that credit card issuers operate ethically and transparently. By collecting specific information from applicants, such as income, employment status, and credit history, issuers can demonstrate that they are assessing creditworthiness responsibly and making informed decisions about extending credit. Compliance with lending laws helps maintain the integrity of the credit card approval process and protects both consumers and issuers.

Key Elements of a Credit Card Application Form

A credit card application form typically includes several key elements that applicants are required to complete. These elements gather essential information about the applicant’s personal, financial, and employment status, allowing the issuer to evaluate their creditworthiness and make an informed decision about approving the credit card application. Understanding these key elements can help applicants prepare and provide accurate information when completing a credit card application form.

Personal Information

One of the primary sections of a credit card application form is personal information, which captures details about the applicant’s identity and contact information. This section typically includes fields for the applicant’s full name, address, phone number, email address, date of birth, and Social Security number. Providing accurate personal information is crucial for verifying the applicant’s identity and ensuring that the issuer can contact them regarding their application.

Financial Information

The financial information section of a credit card application form collects data about the applicant’s income, expenses, assets, and debts. Applicants are typically required to provide details about their current employment status, monthly income, housing costs, outstanding debts, and any other sources of income. By disclosing this financial information, applicants allow the issuer to assess their ability to manage credit responsibly and make timely payments. Providing accurate and up-to-date financial information is essential for a successful credit card application.

Credit History

Another critical element of a credit card application form is the credit history section, which requires applicants to disclose details about their past credit accounts and payment history. This section typically includes questions about previous credit cards, loans, mortgages, and any instances of bankruptcy or default. By providing information about their credit history, applicants give the issuer insight into their past financial behavior and credit management. A positive credit history can enhance an applicant’s chances of approval, while a negative credit history may raise red flags for the issuer.

Terms and Conditions

The terms and conditions section of a credit card application form outlines the specific details of the credit card being offered, including interest rates, fees, grace periods, rewards programs, and other important terms. Applicants are required to review and acknowledge these terms before submitting their application. Understanding the terms and conditions of the credit card is essential for applicants to make an informed decision about whether the card aligns with their financial goals and preferences. By agreeing to the terms and conditions, applicants enter into a legal agreement with the issuer regarding the use of the credit card.

Signature

One of the final steps in completing a credit card application form is signing the document. The applicant’s signature serves as a confirmation that the information provided on the form is accurate and complete. By signing the application form, the applicant acknowledges that they have read and understood the terms and conditions of the credit card and agree to abide by them. The signature also signifies the applicant’s consent to undergo a credit check and provide the issuer with permission to access their credit report. Signing the application form is a crucial step in the credit card application process and demonstrates the applicant’s commitment to responsible credit management.

How to Fill Out a Credit Card Application Form

Filling out a credit card application form may seem like a straightforward task, but attention to detail and accuracy are essential for a successful application. By following a few key steps and tips, applicants can ensure that they provide all necessary information and improve their chances of approval for a credit card.

Read the Instructions Carefully

Before you begin filling out a credit card application form, take the time to read through the instructions provided by the issuer. Understanding the requirements and guidelines for completing the form can help you gather the necessary information and avoid potential errors that could delay your application.

Provide Accurate Information

When completing a credit card application form, accuracy is key. Make sure to provide truthful and up-to-date information about your personal, financial, and employment details. Inaccurate information can lead to delays in processing your application or even result in rejection by the issuer.

Double-Check Your Entries

Before submitting your credit card application form, take the time to review all the information you’ve provided. Double-checking your entries can help you catch any mistakes or omissions that may have occurred while filling out the form. Ensuring the accuracy of your information is essential for a smooth application process.

Sign the Form

Don’t forget to sign the credit card application form before submitting it to the issuer. Your signature serves as confirmation that the information provided is accurate and that you agree to the terms and conditions of the credit card. Without your signature, the issuer may not consider your application complete.

Tips for Completing a Credit Card Application Form

Completing a credit card application form can be a straightforward process if you follow a few helpful tips. These tips can help you navigate the application process with ease and improve your chances of approval for the credit card you desire.

Review Your Credit Report

Before applying for a credit card, it’s a good idea to review your credit report. Checking your credit report can help you identify any errors or discrepancies that may impact your creditworthiness. By addressing any issues beforehand, you can present a more accurate picture of your financial health to the issuer.

Choose the Right Card

When selecting a credit card to apply for, consider your financial goals and spending habits. Choose a card that aligns with your lifestyle and preferences, whether you’re looking for cashback rewards, travel benefits, or low-interest rates. By choosing the right card, you can maximize the benefits and value you receive from your credit card.

Be Honest

Honesty is always the best policy when filling out a credit card application form. Providing accurate and truthful information can increase your chances of approval and help you avoid potential issues down the line. Transparency is key to establishing a positive relationship with the issuer and demonstrating your commitment to responsible credit management.

Understand the Terms

Take the time to read and understand the terms and conditions of the credit card you’re applying for. Pay attention to details such as interest rates, fees, grace periods, and rewards programs. Understanding these terms can help you make an informed decision about whether the card is right for you and ensure that you’re aware of any potential costs associated with the credit card.

Keep Copies

Before submitting your credit card application form, make copies of the completed document for your records. Keeping copies of the application form can serve as a reference point in case you need to follow up on your application or address any issues that may arise. Having a copy of the form can also help you remember the information you provided to the issuer.

Completing a credit card application form is a significant step in the process of obtaining a credit card. By providing accurate information, understanding the terms and conditions, and following these tips, you can enhance your chances of approval and set yourself up for a positive credit card experience. Remember that honesty, attention to detail, and a clear understanding of the credit card terms are key to a successful application process.

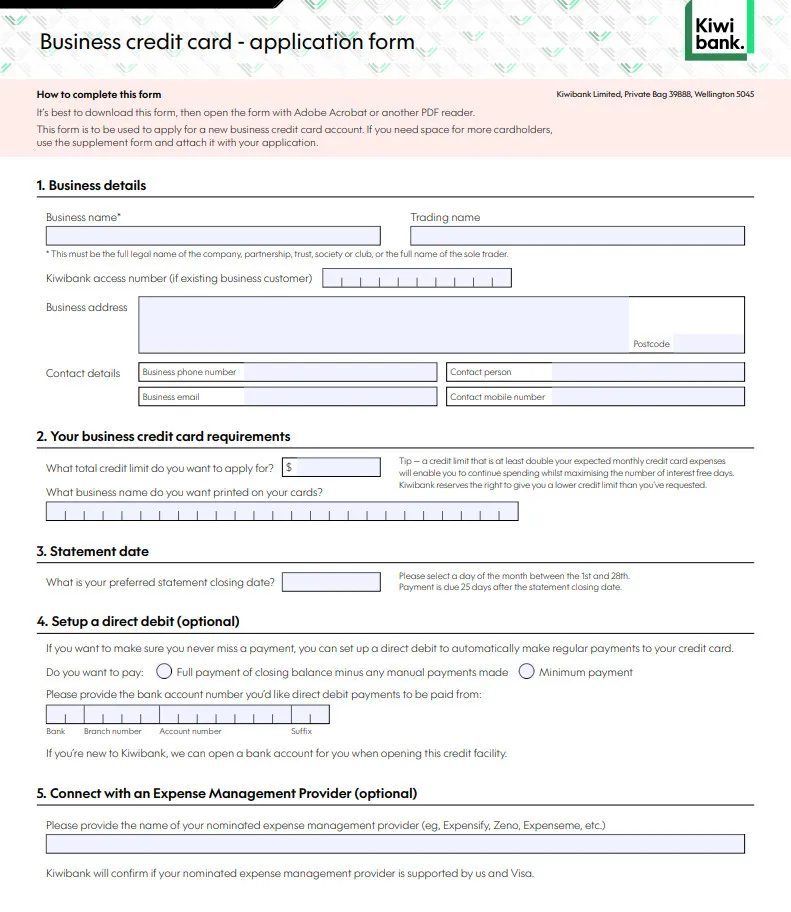

Credit Card Application Form – DOWNLOAD