Whether you’re making a purchase online, over the phone, or signing up for a subscription service, chances are you’ve encountered a credit card authorization form.

But what exactly is a credit card authorization form, and how does it work?

Let’s dive into the details of this important document that serves as written permission from a cardholder to a business.

What is a Credit Card Authorization?

A credit card authorization form is a document that grants permission from a cardholder to a business to charge the cardholder’s credit card for a specific transaction or series of transactions.

This form is typically used when the cardholder is not physically present to provide the card and signature during the transaction, such as for online purchases, phone orders, or recurring payments like subscriptions.

How Do Credit Card Authorizations Work?

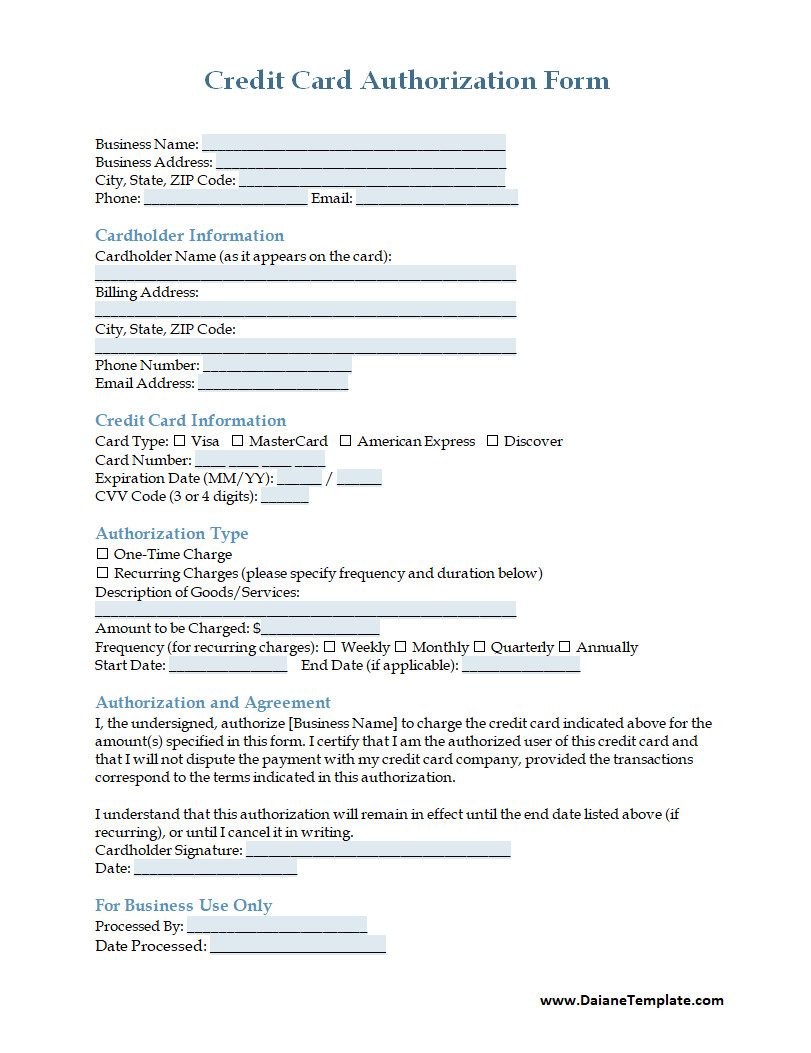

When a cardholder provides their credit card information to a business, the business may ask the cardholder to fill out a credit card authorization form. This form usually includes the cardholder’s name, credit card number, expiration date, billing address, the amount to be charged, and the cardholder’s signature as a confirmation of consent.

Once the form is completed and submitted to the business, the merchant can then process the transaction by using the information provided on the authorization form. This allows the business to charge the cardholder’s credit card without the need for the physical presence of the card or signature.

Submitting a Credit Card Authorization Form

Submitting a credit card authorization form is a straightforward process that typically involves providing all the required information accurately and signing the form to confirm consent. Cardholders must ensure that the information they provide matches the details associated with their credit card to avoid any processing issues.

Businesses may have different methods for submitting credit card authorization forms, such as online submission through a secure portal or email attachment. Cardholders need to follow the specified instructions provided by the business to ensure that their authorization is received and processed promptly.

Processing Credit Card Authorizations

Once a credit card authorization form is submitted, businesses can begin processing the transaction by verifying the information provided and initiating the payment. This process usually involves communicating with the payment processor to charge the cardholder’s credit card for the agreed-upon amount.

Businesses must adhere to industry regulations and best practices when processing credit card authorizations to ensure the security and integrity of the transaction. By following established procedures and guidelines, businesses can minimize the risk of errors or fraud during the payment process.

Basic Elements of a Credit Card Authorization

When filling out a credit card authorization form, several key elements are typically included:

Cardholder Information

The cardholder information section of a credit card authorization form collects essential details about the cardholder, including their name, credit card number, expiration date, billing address, and contact information. This information is used to verify the identity of the cardholder and process the payment accurately.

Cardholders must ensure that the information they provide on the authorization form is up-to-date and matches the details associated with their credit card to avoid any processing delays or errors. Accuracy and completeness are crucial when filling out this section of the form.

Transaction Details

The transaction details section of a credit card authorization form specifies the amount to be charged, the currency of the transaction, and a description of the goods or services being purchased. This information helps clarify the purpose of the payment and ensures that both the cardholder and the business are on the same page regarding the transaction.

Cardholders should review the transaction details carefully before signing the authorization form to confirm that they agree to the payment amount and understand the nature of the transaction. Clear and transparent communication about the transaction details is essential to avoid any misunderstandings or disputes later on.

Authorization Signature

The authorization signature is a critical component of a credit card authorization form, as it serves as confirmation of the cardholder’s consent for the transaction. By signing the form, the cardholder acknowledges their responsibility for the payment and authorizes the business to charge their credit card accordingly.

Cardholders must sign the authorization form using their full legal signature to validate the document and demonstrate their agreement to the terms outlined in the form. The signature acts as a binding agreement between the cardholder and the business, establishing a legal basis for the transaction.

How Long Does a Credit Card Authorization Last?

Most credit card authorizations are valid for a specific period of time, typically between 7 to 30 days. After this period, the authorization may expire, and the business would need to obtain a new authorization from the cardholder before processing any further transactions.

Expiration Dates and Renewals

Expiration dates are an important consideration when it comes to credit card authorizations, as they dictate the duration for which the authorization is valid. Businesses must monitor expiration dates closely to ensure that authorizations do not lapse, and payments can be processed without interruption.

If an authorization expires before the transaction is completed, businesses may need to obtain a new authorization from the cardholder to proceed with the payment. This process may involve contacting the cardholder to request a new authorization form or providing instructions for online renewal, depending on the business’s policies.

Renewal Procedures

Renewing a credit card authorization typically involves obtaining a new authorization form from the cardholder with updated information and consent for the transaction. Businesses must communicate clearly with cardholders about the renewal process and provide instructions on how to submit a new authorization if needed.

By maintaining open communication with cardholders and proactively addressing authorization renewals, businesses can ensure a smooth and seamless payment experience for both parties. Renewing authorizations promptly helps prevent payment processing delays or issues due to expired authorizations.

Tips to Remember When Accepting a Credit Card Authorization

When accepting credit card authorizations as a business, it’s important to keep a few key tips in mind:

Verify Cardholder Information

Verifying the accuracy of cardholder information is crucial to prevent processing errors and ensure that payments are processed correctly. Businesses should confirm that the information provided on the authorization form matches the details associated with the cardholder’s credit card to avoid any potential disputes or chargebacks.

- Check for Typos: Review the cardholder information for any typos or errors that may impact the payment processing.

- Match Billing Address: Ensure that the billing address provided on the authorization form matches the address associated with the credit card for verification purposes.

- Validate Contact Information: Verify that the contact information provided by the cardholder is accurate and up-to-date for communication purposes.

Securely Store Authorization Forms

Protecting the security of authorization forms is essential to safeguard cardholder data and prevent unauthorized access to sensitive information. Businesses should implement secure storage measures to ensure that authorization forms are kept confidential and comply with data protection regulations.

Encryption and Access Controls

Encrypting authorization forms and restricting access to authorized personnel only are effective ways to enhance data security and prevent unauthorized disclosure of cardholder information. By implementing encryption protocols and access controls, businesses can mitigate the risk of data breaches and maintain the integrity of sensitive data.

- Use Encryption Software: Employ encryption software to encrypt authorization forms and protect data from unauthorized access.

- Limit Access: Restrict access to authorization forms to authorized personnel with proper clearance and permissions to view or handle sensitive information.

- Monitor Access Logs: Regularly review access logs and audit trails to track who has accessed authorization forms and detect any suspicious activity.

Compliance with Data Security Standards

Adhering to data security standards such as the Payment Card Industry Data Security Standard (PCI DSS) is crucial for businesses that handle credit card authorizations. Compliance with these standards helps ensure that cardholder data is protected effectively and that businesses meet industry requirements for data security.

- PCI DSS Compliance: Follow the guidelines outlined in the PCI DSS to maintain a secure environment for handling credit card authorizations and protecting cardholder data.

- Regular Security Audits: Conduct regular security audits and assessments to identify vulnerabilities and address any gaps in data security practices.

- Stay Informed: Stay informed about updates and changes to data security regulations to ensure ongoing compliance with industry standards.

Ensuring Transparency and Customer Satisfaction

Transparency and clear communication with cardholders are essential when accepting credit card authorizations to build trust and provide a positive customer experience. By keeping cardholders informed about the authorization process and transaction details, businesses can enhance customer satisfaction and reduce the likelihood of disputes or misunderstandings.

Clear Terms and Conditions

Providing clear and concise terms and conditions on credit card authorization forms helps cardholders understand their obligations and rights regarding the transaction. Clearly outlining the payment terms, refund policies, and cancellation procedures can prevent confusion and ensure that cardholders are aware of the terms they are agreeing to.

- Use Simple Language: Present terms and conditions in easy-to-understand language to ensure clarity for cardholders.

- Highlight Key Points: Emphasize important details such as payment amounts, billing cycles, and renewal terms to help cardholders make informed decisions.

- Provide Contact Information: Include contact information for customer support or inquiries in case cardholders have questions or need assistance.

Responsive Customer Support

Offering responsive customer support and assistance to cardholders who have questions or concerns about credit card authorizations can enhance the overall customer experience. Businesses should be readily available to address cardholder inquiries, clarify any issues, and provide timely assistance to ensure customer satisfaction.

- 24/7 Support: Provide round-the-clock customer support to assist cardholders with authorization-related queries or issues at any time.

- Quick Response Times: Aim to respond promptly to customer inquiries and resolve concerns efficiently to demonstrate a commitment to customer service.

- Train Staff: Train customer support staff to handle authorization-related inquiries effectively and provide accurate information to cardholders.

Stay Informed and Adapt to Changes

In the dynamic landscape of payment processing and data security, businesses must stay informed about industry trends, regulatory changes, and emerging technologies to adapt and evolve their credit card authorization practices. By remaining proactive and responsive to developments in the payment industry, businesses can enhance their processes and protect cardholder data effectively.

Industry Updates and Best Practices

Keeping abreast of industry updates, best practices, and regulatory changes related to credit card authorizations is essential for businesses to maintain compliance and stay ahead of evolving security threats. By monitoring industry news and updates, businesses can implement relevant changes to their authorization processes and data security measures.

- Subscribe to Industry News: Stay informed about industry news and updates related to payment processing, data security, and compliance regulations.

- Attend Training Sessions: Participate in training sessions or webinars that provide insights into best practices for handling credit card authorizations and protecting cardholder data.

- Network with Peers: Engage with industry peers and professionals to exchange knowledge, share experiences, and stay informed about emerging trends in payment processing.

Adapting to Technological Advancements

Embracing technological advancements and innovative solutions in payment processing can help businesses streamline their credit card authorization processes, enhance data security, and improve the overall customer experience. By leveraging technology effectively, businesses can optimize their operations and stay competitive in the evolving payment landscape.

- Explore Payment Solutions: Research and explore new payment solutions, such as tokenization or biometric authentication, to enhance security and convenience for cardholders.

- Implement Fraud Prevention Tools: Utilize fraud prevention tools and technologies to detect and prevent unauthorized transactions and protect cardholder data from fraudulent activities.

- Upgrade Systems Regularly: Regularly update and upgrade payment systems and software to incorporate the latest security features and functionalities for credit card authorization processes.

Credit Card Authorization Form Template

In conclusion, a Credit Card Authorization Form helps businesses securely collect and document customer payment information, reducing errors and ensuring transaction safety.

Protect your business and streamline billing—download our Credit Card Authorization Form Template today to process payments confidently and securely!

Credit Card Authorization Form Template – WORD