When managing the financial health of a company, understanding the intricacies of a debt schedule is crucial. A debt schedule provides a detailed overview of a company’s outstanding debt obligations, including principal amounts, interest rates, and repayment schedules.

This tool is essential for tracking debt management, ensuring timely payments, estimating total debt payoff amounts, monitoring debt maturities, making informed decisions about refinancing, supporting financial statement accuracy, and maintaining healthy investor relations.

What is a Debt Schedule?

A debt schedule is a financial tool that outlines all of a company’s debt obligations in one comprehensive document. It includes details such as the total amount of debt owed, the interest rates associated with each debt, the repayment schedules, and any other pertinent information related to the company’s outstanding debt.

This schedule is crucial for effective debt management and financial planning.

Why is a Debt Schedule Important?

A debt schedule is important for several reasons.

Ensuring Timely Payments

One of the primary reasons why a debt schedule is important is to ensure timely payments on all debts. By having a clear overview of when payments are due and how much is owed, companies can avoid missing payment deadlines and incurring penalties. Timely payments are crucial for maintaining a good credit rating and strong financial standing.

Estimating Total Debt Payoff Amounts

Another key benefit of a debt schedule is the ability to estimate total debt payoff amounts. By calculating the total amount of debt owed, including principal and interest payments, companies can develop a clear plan for paying off their debts on time. This can help companies avoid accumulating excessive debt and ensure long-term financial stability.

Monitoring Debt Maturities

A debt schedule also allows companies to monitor debt maturities effectively. By keeping track of when debts are due to be repaid in full, companies can plan ahead and ensure that they have the necessary funds available to meet their obligations. This proactive approach to debt management can help companies avoid financial crises and maintain a healthy cash flow.

Making Informed Decisions About Refinancing

Understanding a company’s debt obligations is essential for making informed decisions about refinancing. A debt schedule provides valuable information on interest rates, repayment schedules, and total debt amounts, allowing companies to assess whether refinancing would be beneficial. By refinancing at lower interest rates or restructuring debts, companies can potentially save money and improve their financial position.

Supporting Financial Statement Accuracy

Accurate financial reporting is essential for building trust with investors and stakeholders. A debt schedule ensures that all debt obligations are properly documented and disclosed in financial statements, enhancing transparency and accountability. By accurately reporting debts, companies can demonstrate their financial stability and credibility to investors, lenders, and other stakeholders.

Maintaining Healthy Investor Relations

Investor relations are critical for the success of a company, and a debt schedule plays a key role in maintaining healthy investor relations. By providing investors with accurate and up-to-date information on debt obligations, companies can build trust and credibility. Investors are more likely to invest in companies that demonstrate strong financial management practices and transparency in reporting.

Types of Debt Listed in a Debt Schedule

Several types of debt may be listed in a debt schedule, each with its own unique characteristics and implications for financial management:

Long-Term Debt

Long-term debt typically refers to loans or bonds with repayment terms longer than one year. This type of debt is used to finance long-term investments, such as purchasing assets or expanding operations. Long-term debt often carries lower interest rates than short-term debt, making it an attractive option for companies looking to secure funding for large projects.

Short-Term Debt

Short-term debt includes loans or credit lines with repayment terms of one year or less. This type of debt is used to finance day-to-day operations or cover short-term expenses. Short-term debt often carries higher interest rates than long-term debt, reflecting the higher risk associated with short-term borrowing. Managing short-term debt effectively is crucial for maintaining liquidity and financial stability.

Revolving Credit

Revolving credit is a type of debt that allows companies to borrow, repay, and borrow again up to a certain limit. This form of credit provides flexibility and convenience for companies that have fluctuating financing needs. Revolving credit typically carries variable interest rates, which can change based on market conditions. Using revolving credit responsibly can help companies manage cash flow and meet short-term financing needs.

Convertible Debt

Convertible debt is a unique type of debt that can be converted into equity at a certain point in the future. This type of debt provides companies with the option to raise funds through debt financing while offering investors the potential to convert their debt into ownership stakes in the company. Convertible debt can be an attractive option for companies seeking flexible financing options and investors looking for potential equity upside.

Components of a Debt Schedule in a Financial Model

When building a debt schedule in a financial model, several key components should be included to ensure the accuracy and completeness of the schedule:

Principal Amount

The principal amount is the total amount of debt owed by the company, excluding interest. This amount represents the initial borrowing that must be repaid to the lender. The principal amount is a critical component of the debt schedule as it forms the basis for calculating interest payments and determining the total debt obligation.

Interest Rate

The interest rate is the rate at which interest is charged on the principal amount of the debt. Interest rates can be fixed or variable, depending on the terms of the loan or bond. Including the interest rate in the debt schedule is essential for calculating interest expense, determining the total cost of borrowing, and assessing the impact of interest rate changes on debt payments.

Repayment Schedule

The repayment schedule outlines the timeline for repaying the debt, including details on when payments are due and the amount of each payment. This schedule typically includes both principal and interest payments and may be structured as monthly, quarterly, or annual payments. The repayment schedule helps companies understand their cash flow requirements and ensures that they can meet their debt obligations on time.

Maturity Date

The maturity date is the date when the debt is due to be repaid in full, including all principal and interest payments. This date is crucial for planning and managing debt repayment, as it represents the deadline by which the company must settle its debt with the lender. Including the maturity date in the debt schedule helps companies track when debts are due and ensure that they have the necessary funds available for repayment.

Debt Type

Identifying the type of debt in the debt schedule is essential for understanding the terms and conditions of each debt obligation. Different types of debt, such as long-term loans, bonds, or lines of credit, may have unique features that impact repayment terms, interest rates, and other factors. By specifying the type of debt in the schedule, companies can tailor their debt management strategies accordingly.

Collateral

Certain debts may be secured by collateral, such as assets or property, to provide additional security for the lender. Including information on collateral in the debt schedule is important for assessing the level of risk associated with each debt obligation. Collateralized debts may have lower interest rates or more favorable terms, but they also carry the risk of asset seizure in the event of default.

Terms and Conditions

Each debt obligation may have specific terms and conditions that govern the repayment terms, interest rates, covenants, and other provisions. Including details on the terms and conditions of each debt in the schedule helps companies understand their obligations and comply with lender requirements. Failure to adhere to these terms and conditions could result in penalties or default, impacting the company’s financial health.

Interest Calculation Method

The method used to calculate interest on each debt, whether simple interest or compound interest, can impact the total cost of borrowing and the timing of interest payments. Including information on the interest calculation method in the debt schedule ensures that companies accurately calculate interest expenses and understand how interest accrues over time. This information is critical for budgeting and forecasting cash flow.

Amortization Schedule

An amortization schedule outlines the repayment of principal and interest over the life of the debt, detailing how each payment is allocated between principal reduction and interest expense. Including an amortization schedule in the debt schedule helps companies track the reduction of their debt over time and understand how each payment contributes to debt repayment. This schedule is essential for long-term financial planning.

Default Provisions

Default provisions specify the conditions under which a company would be considered in default on its debt obligations, such as missing payments, breaching covenants, or failing to meet other lender requirements. Including information on default provisions in the debt schedule helps companies understand the consequences of default and take proactive measures to avoid default situations. This information is critical for risk management and contingency planning.

Refinancing Options

Assessing refinancing options is an important aspect of debt management, as companies may choose to refinance existing debt to secure more favorable terms, lower interest rates, or extend repayment periods. Including information on potential refinancing options in the debt schedule helps companies evaluate the costs and benefits of refinancing and make informed decisions about restructuring their debt. This analysis can help companies optimize their debt portfolio and improve financial flexibility.

Debt Service Coverage Ratio

The debt service coverage ratio (DSCR) is a financial metric used to assess a company’s ability to meet its debt obligations based on its operating income. Including the DSCR in the debt schedule helps companies evaluate their financial health and determine whether they have sufficient cash flow to cover debt payments. Monitoring the DSCR over time can help companies identify potential financial challenges and take proactive steps to manage their debt effectively.

Debt-to-Equity Ratio

The debt-to-equity ratio is a financial ratio that compares a company’s total debt to its shareholders’ equity, providing insights into the company’s leverage and financial risk. Including the debt-to-equity ratio in the debt schedule helps companies assess their capital structure and financial stability. Monitoring changes in the debt-to-equity ratio over time can help companies make strategic decisions about debt management and capital allocation.

Factors to Consider in the Construction of a Debt Schedule

When constructing a debt schedule, there are several key factors to consider to ensure its accuracy, relevance, and effectiveness in supporting financial management:

Interest Rates

Interest rates play a critical role in determining the cost of borrowing and the total amount of interest payments on each debt obligation. Companies should carefully consider the interest rates associated with each debt when constructing the debt schedule to accurately calculate interest expenses and assess the impact of interest rate changes on debt payments. Monitoring interest rates over time can help companies identify opportunities for refinancing or debt restructuring.

Payment Terms

The payment terms of each debt, including the frequency and amount of payments, are essential components of the debt schedule. Understanding the payment terms helps companies manage their cash flow effectively, ensure timely payments on debts, and avoid default situations. Companies should consider the timing and size of payments when constructing the debt schedule to align with their financial capabilities and obligations.

Debt Covenants

Debt covenants are provisions included in loan agreements that restrict a company’s activities or impose certain requirements on the borrower to protect the lender’s interests. Companies should carefully consider the debt covenants associated with each debt when constructing the debt schedule to ensure compliance with lender requirements and avoid default situations. Monitoring debt covenants regularly can help companies maintain healthy lender relationships and mitigate compliance risks.

Repayment Structures

The repayment structures of each debt, such as fixed or variable repayment schedules, balloon payments, or interest-only periods, can impact the timing and amount of debt payments. Companies should consider the repayment structures of each debt when constructing the debt schedule to ensure that they have the necessary funds available to meet their obligations. Understanding the repayment structures helps companies plan for future cash flow requirements and optimize debt repayment strategies.

Debt Maturities

The maturity dates of each debt represent the deadlines by which the debts must be repaid in full, including all principal and interest payments. Companies should carefully track the debt maturities when constructing the debt schedule to ensure that they have the necessary funds available to meet their obligations on time. Monitoring debt maturities allows companies to plan, avoid liquidity issues, and maintain healthy financial management practices.

Interest Rate Risks

Interest rate risks refer to the potential impact of changes in interest rates on debt payments and borrowing costs. Companies should consider interest rate risks when constructing the debt schedule to assess the vulnerability of their debt portfolio to interest rate fluctuations. Hedging strategies, such as fixed-rate loans or interest rate swaps, can help companies mitigate interest rate risks and protect against unexpected changes in borrowing costs.

Debt Sustainability

Debt sustainability refers to a company’s ability to maintain its debt obligations over the long term without jeopardizing its financial health. Companies should consider debt sustainability when constructing the debt schedule to ensure that they can manage their debt effectively and avoid excessive leverage. Monitoring key financial metrics, such as the debt service coverage ratio and debt-to-equity ratio, can help companies assess their debt sustainability and make informed decisions about debt management.

Cash Flow Management

Cash flow management is essential for ensuring that companies have sufficient funds available to meet their debt obligations on time. Companies should consider their cash flow projections when constructing the debt schedule to align debt payments with expected cash inflows. Monitoring cash flow regularly can help companies anticipate potential liquidity issues, plan for future financing needs, and optimize debt repayment strategies to maintain healthy financial management practices.

Risk Assessment

Risk assessment involves evaluating the potential risks associated with each debt obligation and developing strategies to mitigate these risks. Companies should consider risk assessment when constructing the debt schedule to identify potential challenges, such as default risks, interest rate risks, or refinancing risks. Implementing risk mitigation strategies, such as diversifying debt sources or establishing contingency plans, can help companies manage risks effectively and maintain financial stability.

Regulatory Compliance

Regulatory compliance refers to the company’s adherence to relevant laws, regulations, and accounting standards related to debt reporting and financial management. Companies should consider regulatory compliance when constructing the debt schedule to ensure that all debt obligations are accurately disclosed in financial statements and reports. Failure to comply with regulatory requirements can result in fines, penalties, or legal consequences, impacting the company’s reputation and financial health.

Financial Statement Accuracy

Financial statement accuracy is essential for building trust with investors and stakeholders and demonstrating the company’s financial stability. Companies should consider financial statement accuracy when constructing the debt schedule to ensure that all debt obligations are properly documented and disclosed in financial reports. Regularly reviewing and updating the debt schedule can help companies maintain accurate financial statements and provide stakeholders with reliable information on the company’s financial health.

How to Build a Debt Schedule

Building a debt schedule involves several steps to gather, organize, and analyze information on each debt obligation in a comprehensive and structured manner. Companies can follow these steps to build an effective debt schedule:

Gather Debt Details

The first step in building a debt schedule is to gather all relevant details for each debt obligation. This includes information on the principal amount owed, the interest rate charged, the repayment schedule, the maturity date, and any other terms and conditions associated with the debt. Companies should collect all documentation related to their debts, such as loan agreements, bond indentures, and credit agreements, to ensure accuracy in the debt schedule.

Organize Information

Once all debt details have been gathered, companies should organize the information into a clear and structured format. This can be done using a spreadsheet, financial modeling software, or other tools that allow for easy manipulation and analysis of data. Companies should create separate sections for each debt obligation, including all relevant information such as principal amounts, interest rates, repayment schedules, and maturity dates.

Calculate Total Debt Obligations

After organizing the debt information, companies should calculate the total debt obligations for the entire debt portfolio. This involves summing up the principal amounts of all debts, as well as estimating the total interest payments based on the interest rates and repayment schedules. By calculating the total debt obligations, companies can assess the overall financial impact of their debts and develop a clear repayment plan.

Create a Payment Schedule

Once the total debt obligations have been calculated, companies should create a payment schedule that outlines when each debt payment is due and how much is owed. This schedule should consider the frequency of payments, the amount of each payment, and any special conditions, such as balloon payments or interest-only periods. The payment schedule helps companies track their debt payments and ensure timely repayment of all obligations.

Include Amortization Tables

Amortization tables provide a detailed breakdown of how each debt payment is allocated between principal reduction and interest expense over the life of the debt. Including amortization tables in the debt schedule helps companies visualize the progress of debt repayment and understand the impact of each payment on reducing the overall debt balance. This information is essential for long-term financial planning and debt management.

Review and Update Regularly

It is important for companies to regularly review and update the debt schedule to ensure its accuracy and relevance. Changes in interest rates, repayment schedules, or other terms and conditions can impact the debt obligations and require adjustments to the schedule. By reviewing and updating the debt schedule regularly, companies can stay informed about their financial commitments and make informed decisions about debt management.

Utilize Financial Modeling Software

Financial modeling software can streamline the process of building and maintaining a debt schedule by automating calculations, generating reports, and providing real-time insights into a company’s debt obligations. These tools allow companies to create dynamic and interactive debt schedules that can be easily updated and customized to meet specific reporting requirements. By utilizing financial modeling software, companies can improve the accuracy and efficiency of their debt schedule management.

Seek Professional Assistance

If companies are unsure about how to construct a debt schedule or if they have complex debt structures that require expert analysis, it may be beneficial to seek professional assistance from financial advisors, accountants, or consultants. These professionals can provide valuable insights and guidance on debt management strategies, debt schedule construction, and financial planning. By leveraging external expertise, companies can ensure that their debt schedules are accurate, comprehensive, and effective in supporting financial management.

Tips for an Effective Debt Schedule

To ensure that a debt schedule is effective and useful for financial management, consider the following tips:

Be Detailed

Include all relevant information about each debt obligation in the debt schedule, such as principal amounts, interest rates, repayment schedules, and maturity dates. The more detailed and comprehensive the debt schedule, the better companies can track their debt obligations and make informed financial decisions.

Stay Organized

Keep the debt schedule well-organized and structured in a logical manner to ensure easy navigation and reference. Use clear headings, formatting, and labeling to distinguish between different debt obligations and key components of the schedule. A well-organized debt schedule makes it easier for companies to analyze their debts and manage their financial resources effectively.

Regularly Update

Review and update the debt schedule regularly to reflect any changes in debt obligations, interest rates, repayment schedules, or other terms and conditions. By keeping the debt schedule up to date, companies can ensure accuracy in their financial reporting, make timely debt payments, and stay informed about their financial commitments.

Use Software Tools

Consider using financial modeling software or tools to streamline the process of building and maintaining a debt schedule. These tools can automate calculations, generate reports, and provide real-time insights into a company’s debt obligations, making it easier to analyze and manage debt effectively. By utilizing software tools, companies can improve the efficiency and accuracy of their debt schedule management.

Monitor Key Metrics

Monitor key financial metrics, such as the debt service coverage ratio, debt-to-equity ratio, and interest coverage ratio, to assess the company’s financial health and debt sustainability. By tracking these metrics over time, companies can identify potential risks, optimize debt management strategies, and make informed decisions about refinancing or restructuring debt. Monitoring key metrics helps companies maintain financial stability and make strategic financial decisions.

Seek Professional Advice

If companies have complex debt structures or require expert guidance on debt management, it may be beneficial to seek professional advice from financial advisors, accountants, or consultants. These professionals can provide valuable insights, analysis, and recommendations on debt schedule construction, debt management strategies, and financial planning. By consulting with experts, companies can ensure that their debt schedules are accurate, reliable, and effective in supporting financial management.

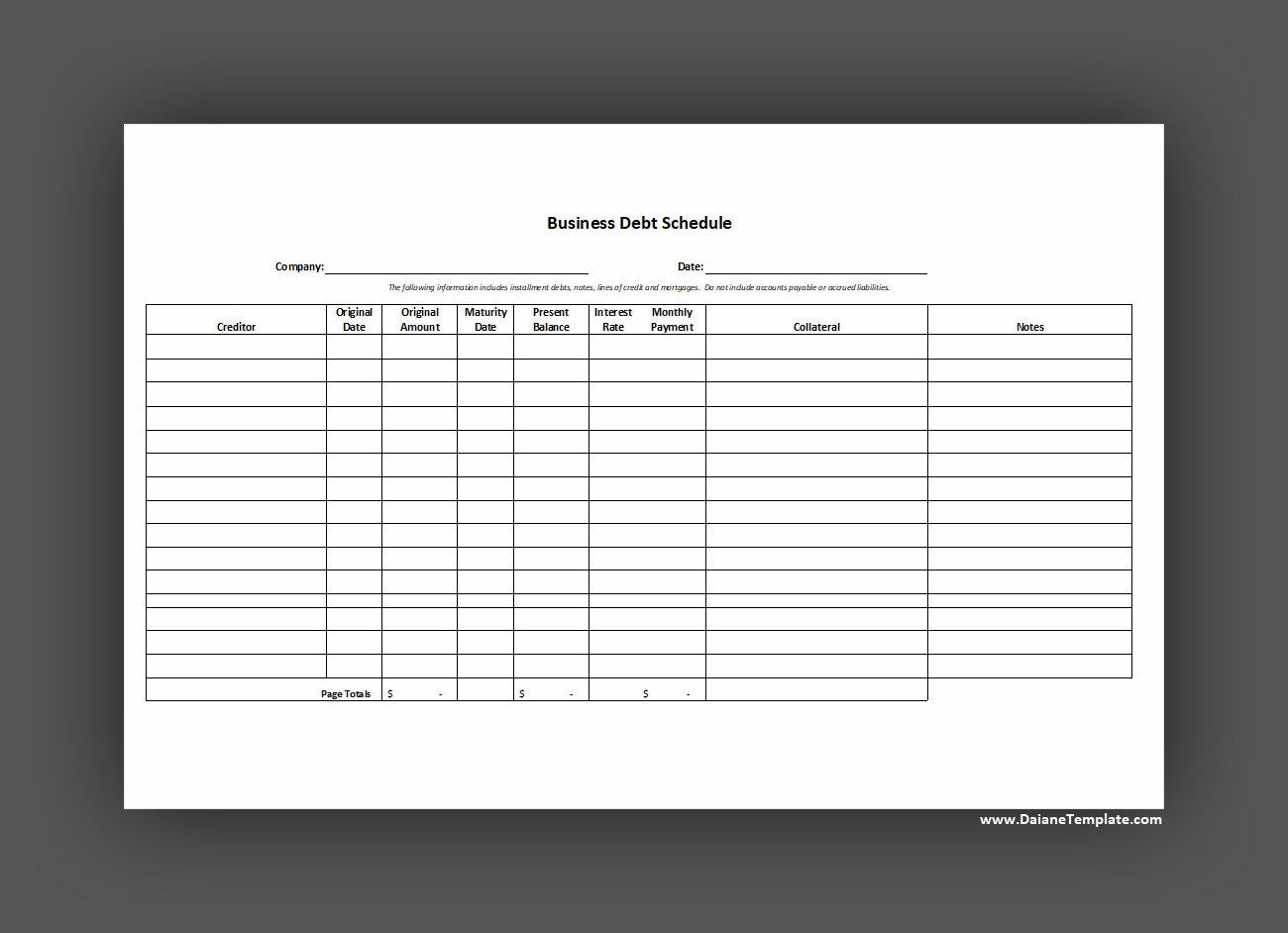

Debt Schedule Template

A debt schedule template is a valuable financial tool that helps you organize and track all outstanding debts in one place. It provides a clear overview of balances, interest rates, payment dates, and due amounts, making it easier to manage repayments and plan your finances effectively. Perfect for individuals or businesses, this template promotes transparency and financial control.

Download and use our debt schedule template today to stay organized, monitor your obligations, and take charge of your debt repayment strategy.

Debt Schedule Template – Excel