What is a Direct Deposit Authorization Form?

A direct deposit authorization form is a document that employees complete to grant their employer permission to deposit their paychecks directly into their bank accounts.

This form serves as a critical piece in the payroll process, enabling seamless electronic transfer of funds from the employer to the employee without the need for physical checks. By providing their banking details and consent on this form, employees authorize their employer to initiate direct deposits on payday.

Why Use Direct Deposit Authorization Forms?

Efficiency and Time Savings

One of the primary reasons to use direct deposit authorization forms is the efficiency and time savings they offer in the payroll process. Unlike traditional paper checks, which require printing, signing, distributing, and reconciling, direct deposit streamlines the payment process by electronically transferring funds directly into employees’ bank accounts. This eliminates the need for manual handling of checks, reducing the time and resources spent on payroll administration. Employers can save time and effort by automating the payment process through direct deposit authorization forms.

Cost-Effectiveness and Resource Allocation

Direct deposit authorization forms also contribute to cost-effectiveness and efficient resource allocation within an organization. By transitioning to electronic payments, employers can save on printing and postage costs associated with paper checks. Additionally, the time saved on manual payroll processing can be redirected towards more strategic tasks that drive business growth and innovation. This reallocation of resources can enhance the overall productivity and effectiveness of the organization, allowing employees to focus on value-added activities rather than administrative tasks.

Security and Fraud Prevention

Direct deposit authorization forms enhance security and reduce the risk of fraud associated with paper checks. Electronic fund transfers are more secure than physical checks, as they eliminate the potential for lost or stolen payments. By securely transmitting funds directly to employees’ bank accounts, employers can protect sensitive financial information and reduce the likelihood of payment errors or fraudulent activities. Enhanced security measures, such as multi-factor authentication and transaction monitoring, add an extra layer of protection to the direct deposit process, ensuring that payments are secure and tamper-proof.

Convenience and Employee Satisfaction

Employees benefit from the convenience and flexibility offered by direct deposit authorization forms. With direct deposit, employees no longer need to visit a bank or check-cashing service to access their paychecks. Funds are deposited directly into their bank accounts on payday, providing quick and easy access to their earnings. This convenience enhances employee satisfaction and morale, as it eliminates the hassle of handling physical checks and waiting for payments to clear. By offering direct deposit as a payment option, employers can attract and retain top talent who value convenience and efficiency in their compensation.

Environmental Sustainability and Paperless Operations

Direct deposit authorization forms contribute to environmental sustainability by reducing paper waste and promoting paperless operations. By eliminating the need for physical checks, employers can reduce their carbon footprint and support eco-friendly practices in the workplace. Going paperless not only benefits the environment but also streamlines administrative processes by digitizing payment records and reducing paper clutter. Employers can align with corporate social responsibility goals by adopting direct deposit as a sustainable payment method that minimizes paper usage and promotes environmental stewardship.

Key Elements of a Direct Deposit Authorization Form

Employee Information

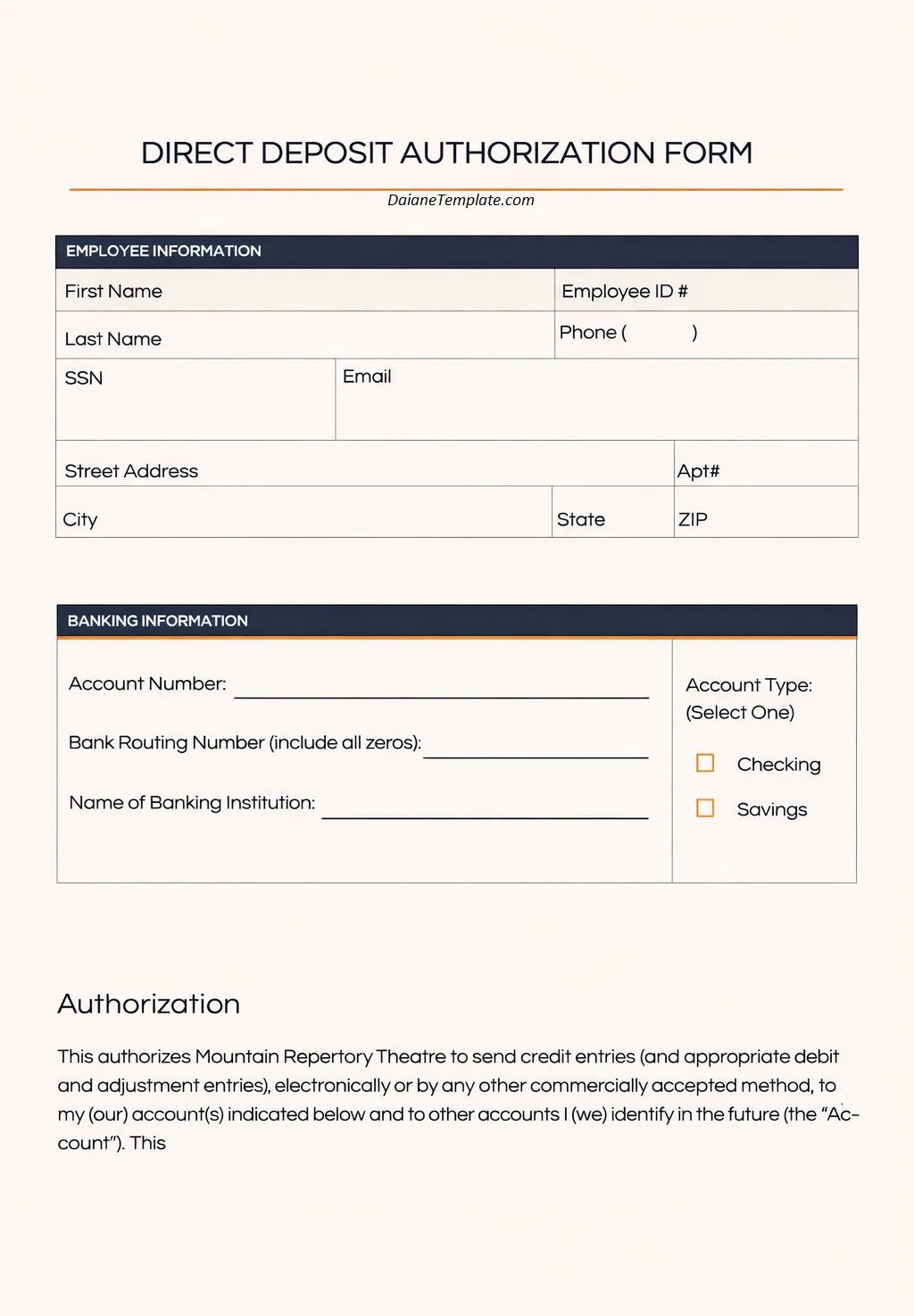

The first key element of a direct deposit authorization form is the employee’s personal information, including their full name, address, and contact details. This information is essential for identifying the employee and ensuring that payments are directed to the correct individual. Employers should verify the accuracy of employee information to prevent payment errors and discrepancies in the direct deposit process.

Banking Details

Another critical element of a direct deposit authorization form is the employee’s banking details, such as their bank account number and routing number. These details are necessary for initiating electronic fund transfers and depositing paychecks directly into the employee’s account. Employers must ensure the security and confidentiality of employee banking information to protect against unauthorized access or misuse.

Authorization for Electronic Deposit

The core component of a direct deposit authorization form is the employee’s authorization for electronic deposit. By signing the form, the employee consents to have their paychecks deposited directly into their bank account on payday. This authorization is a legal requirement for initiating direct deposit payments and must be obtained from the employee before processing electronic transfers.

Signature and Date

The employee’s signature and the date of authorization are essential elements of a direct deposit form, as they serve as proof of the employee’s consent and the timing of the authorization. The signature confirms that the employee has read and agreed to the terms of the direct deposit arrangement, while the date records when the authorization was provided. Employers should retain signed authorization forms for record-keeping purposes and compliance with regulatory requirements.

Compliance with Legal Regulations

Direct deposit authorization forms must comply with legal regulations governing electronic fund transfers and payroll processing. Employers should be aware of federal and state laws related to direct deposit, such as the Electronic Fund Transfer Act (EFTA) and the Fair Labor Standards Act (FLSA). These laws establish guidelines for electronic payments, including consent requirements, disclosure obligations, and employee rights related to direct deposit. By adhering to legal regulations, employers can ensure that their direct deposit processes are lawful and transparent.

How to Implement Direct Deposit Authorization Forms

Create a Standardized Form

The first step in implementing direct deposit authorization forms is to create a standardized form that complies with legal requirements and internal policies. The form should include all necessary fields for employee information, banking details, authorization for electronic deposit, signature, and date. Employers may use templates provided by payroll processors or create custom forms tailored to their organization’s needs.

Distribute Forms to Employees

Once the direct deposit authorization form is finalized, employers should distribute the forms to all employees who wish to enroll in direct deposit. Communication is key during this phase to ensure that employees understand the benefits of direct deposit, the process for completing the form, and any deadlines for submission. Employers may provide instructions in person, via email, or through an employee portal to reach all staff members effectively.

Collect and Verify Completed Forms

After distributing the direct deposit authorization forms, employers should collect completed forms from employees and verify the accuracy of the information provided. It is essential to cross-check banking details, signatures, and dates to confirm that all forms are complete and valid. Employers may reach out to employees for clarification or corrections if any discrepancies are identified during the verification process.

Submit Forms for Processing

Once all direct deposit authorization forms have been collected and verified, employers should submit the forms for processing to their payroll processor or financial institution. This step involves transmitting the authorized forms securely to initiate electronic fund transfers on payday. Employers must follow the submission guidelines provided by their financial institution to ensure that direct deposits are processed accurately and on time.

Test the Direct Deposit System

Before implementing direct deposit for all employees, it is recommended to test the direct deposit system to ensure that payments are processed correctly. Employers can conduct a trial run by initiating a test deposit for a sample group of employees to validate the accuracy of the electronic transfer process. Testing helps identify any errors or issues that may arise during the initial phase of direct deposit implementation and allows employers to address them proactively.

Communicate with Employees

Throughout the implementation process, employers should maintain open communication with employees to address any questions or concerns related to direct deposit. Providing updates on the progress of implementation, responding to employee inquiries, and offering support and assistance are essential to ensuring a smooth transition to direct deposit. Employers can host information sessions, create FAQs, and establish a dedicated point of contact for direct deposit-related queries to facilitate employee communication. By keeping employees informed and engaged throughout the implementation process, employers can promote transparency and build trust in the direct deposit system.

Monitor and Evaluate

After the direct deposit system has been implemented, employers should monitor and evaluate its performance to ensure ongoing success. Regularly reviewing direct deposit transactions, reconciling payments, and addressing any discrepancies or issues that arise are essential tasks for maintaining the integrity of the system. Employers may also solicit feedback from employees to gather insights on their experience with direct deposit and identify areas for improvement or enhancement.

Tips for Successful Implementation

Provide Clear Instructions

Clear and concise instructions are essential for the successful implementation of direct deposit authorization forms. Employers should communicate the steps for completing the form, submitting it for processing, and straightforwardly enrolling in direct deposit. By providing detailed instructions and addressing common questions upfront, employers can help employees navigate the direct deposit process with confidence and ease.

Communicate Benefits Effectively

Effectively communicating the benefits of direct deposit is key to encouraging employee participation. Employers should emphasize the advantages of electronic payments, such as faster access to funds, enhanced security, and environmental sustainability. Highlighting how direct deposit improves the employee experience and simplifies the payment process can motivate employees to enroll in the program and reap the benefits of electronic payments.

Maintain Accurate Records

Accurate record-keeping is essential for compliance, audit purposes, and dispute resolution in direct deposit processing. Employers should maintain detailed records of direct deposit authorization forms, payment transactions, and employee communications related to electronic payments. Keeping accurate records ensures transparency and accountability in the direct deposit process and enables employers to address any discrepancies or inquiries promptly.

Verify Bank Account Information

Verifying the accuracy of employee bank account information is critical for preventing payment errors and ensuring that direct deposits are processed correctly. Employers should cross-check bank account numbers, routing numbers, and other banking details provided on direct deposit authorization forms to confirm their validity. Verifying bank account information helps mitigate the risk of payment delays, incorrect deposits, or potential fraud in the direct deposit process.

Conduct Regular Audits

Regular audits of the direct deposit system are essential for detecting anomalies, identifying potential issues, and maintaining compliance with regulatory requirements. Employers should conduct periodic reviews of direct deposit transactions, payment records, and security protocols to assess the integrity of the system. Audits help identify areas for improvement, address any non-compliance issues, and ensure that direct deposit processes align with best practices and industry standards.

Offer Employee Assistance

Assisting employees who have questions or concerns about direct deposit is key to fostering a positive experience with electronic payments. Employers should offer support channels, such as help desks, FAQs, or dedicated personnel, to address employee inquiries promptly. By offering guidance and assistance throughout the direct deposit implementation process, employers can enhance employee satisfaction and promote a seamless transition to electronic payments.

Stay Informed on Regulations

Staying informed on regulations and best practices related to direct deposit processing is essential for compliance and risk management. Employers should regularly review federal and state laws governing electronic fund transfers, payroll processing, and data security to ensure that their direct deposit procedures align with legal requirements. By staying up to date on regulatory changes and industry trends, employers can mitigate potential risks, address compliance issues proactively, and maintain the integrity of their direct deposit system.

Conclusion

Direct deposit authorization forms play a vital role in modern payroll processing, offering efficiency, security, and convenience for both employers and employees. By understanding the key elements, benefits, and tips for successful implementation of direct deposit, employers can streamline their payment processes, enhance data security, and improve the overall employee experience.

Embracing electronic payments through direct deposit not only saves time and resources but also promotes environmental sustainability and compliance with legal regulations.

Employers who invest in direct deposit authorization forms and prioritize employee communication, security, and continuous improvement can reap the rewards of a modern, efficient, and reliable payroll system.

Direct Deposit Authorization Form – DOWNLOAD