Personal debt agreements serve as formal, legally binding contracts that outline the terms of a loan between a lender and a borrower. They can also act as a structured alternative to bankruptcy for individuals with unmanageable debts.

Whether used for personal loans or debt relief, these agreements provide clarity for both parties and legal recourse in case of disputes.

What is a Personal Debt Agreement?

A personal debt agreement is a formal contract between a borrower and a lender that specifies the terms of a loan. It includes details such as loan amounts, interest rates, and repayment schedules.

For individuals facing overwhelming debts, a personal debt agreement can offer a structured way to settle debts without resorting to full bankruptcy.

Why Use a Personal Debt Agreement?

There are several reasons why individuals may choose to use a personal debt agreement:

Structured Debt Repayment

A personal debt agreement provides a clear repayment plan for borrowers, helping them manage their debts effectively. By outlining the terms of the loan, including the amount borrowed, interest rate, and repayment schedule, borrowers can stay organized and track their progress towards debt repayment.

Legal Protection

By formalizing the terms of the loan in a contract, both borrowers and lenders have legal protection in case of disputes or non-payment. If there is a disagreement regarding the terms of the agreement or if the borrower fails to make payments as agreed, the contract serves as a legal document that outlines the responsibilities of each party.

Alternative to Bankruptcy

For individuals facing financial difficulties, a personal debt agreement can offer a more manageable solution than filing for bankruptcy. Rather than declaring insolvency and potentially losing assets to pay off creditors, a personal debt agreement allows the borrower to negotiate more favorable repayment terms while avoiding the long-term consequences of bankruptcy.

What to Include in a Personal Debt Agreement?

When drafting a personal debt agreement, it is essential to include the following key elements:

Loan Amount

One of the most critical aspects of a personal debt agreement is specifying the loan amount borrowed by the borrower. This amount should be clearly stated in the agreement, along with any conditions regarding additional borrowing or changes to the loan amount.

Interest Rate

Detailing the interest rate applied to the loan amount is crucial for both parties to understand the cost of borrowing. The interest rate should be clearly outlined in the agreement, along with any provisions for changes to the rate over time or under specific circumstances.

Repayment Schedule

The repayment schedule in a personal debt agreement outlines the agreed-upon plan for repaying the loan. This schedule should include details such as the frequency of payments, the amount of each payment, and the total duration of the repayment period. Both parties need to adhere to the repayment schedule to avoid defaulting on the loan.

Consequences of Non-Payment

Including provisions for the consequences of non-payment in a personal debt agreement is crucial for protecting the interests of both parties. These consequences may include late fees, additional interest charges, or legal actions in the event of default. By outlining these consequences in the agreement, both parties understand the potential repercussions of failing to meet their obligations.

How to Create a Personal Debt Agreement

Creating a personal debt agreement involves the following steps:

Consultation

Before drafting a personal debt agreement, it is essential to have a thorough consultation with the other party involved in the loan. During this consultation, both parties can discuss the terms of the agreement, negotiate any necessary changes, and ensure mutual understanding of the terms and conditions.

Documentation

Once the terms of the personal debt agreement have been agreed upon, it is essential to document these terms in a formal written contract. The contract should include all key elements of the agreement, such as the loan amount, interest rate, repayment schedule, and consequences of non-payment. Both parties should review the documentation carefully to ensure accuracy and clarity.

Review

After drafting the personal debt agreement, it is crucial to review the document with both parties to ensure that all terms are clearly understood and agreed upon. This review process provides an opportunity to address any questions or concerns that either party may have and make any necessary revisions to the agreement before finalizing it.

Signing

Once both parties are satisfied with the terms of the personal debt agreement, it is time to sign the document to make it legally binding. The signatures of both the borrower and lender indicate their consent to the terms of the agreement and their commitment to fulfilling their respective obligations under the contract.

Tips for Using a Personal Debt Agreement

Here are some tips for effectively using a personal debt agreement:

Seek Legal Advice

Before entering into a personal debt agreement, it is advisable to seek legal advice from a qualified professional. A legal expert can review the terms of the agreement, ensure that it complies with relevant laws and regulations, and provide guidance on how to protect your rights and interests.

Be Transparent

Transparency is key when using a personal debt agreement. Both parties should communicate openly and honestly about the terms of the agreement to avoid misunderstandings or conflicts down the line. By maintaining clear and open communication throughout the process, borrowers and lenders can build trust and work together towards successful debt repayment.

Keep Records

It is essential to keep detailed records of all communications, payments, and changes to the personal debt agreement. Maintaining accurate records can help prevent misunderstandings or disputes in the future and provide a clear trail of documentation in case legal action is necessary. Both parties should keep copies of all relevant documents and correspondence related to the agreement.

Regularly Review

Periodically reviewing the terms of the personal debt agreement is essential to ensure that it continues to meet the needs and expectations of both parties. As circumstances change or new information arises, it may be necessary to revisit the terms of the agreement and make adjustments as needed. By staying proactive and regularly reviewing the agreement, borrowers and lenders can address any issues promptly and maintain a positive working relationship.

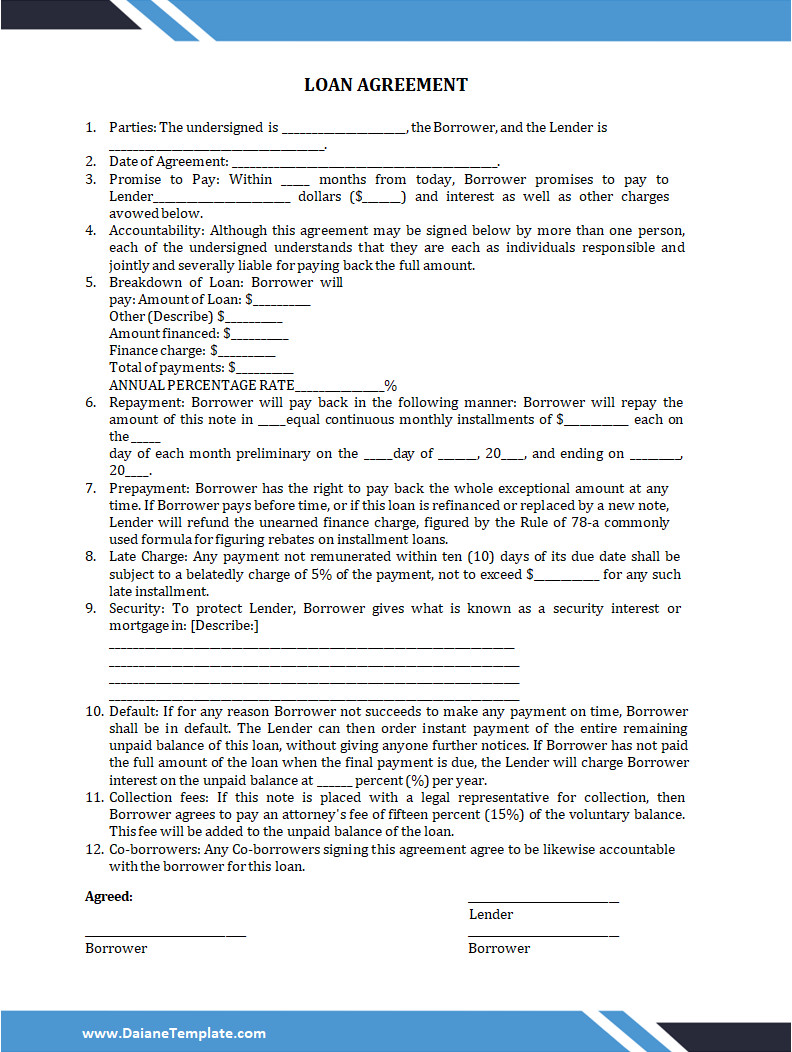

Personal Debt Agreement Template

In conclusion, a Personal Debt Agreement Template provides a clear and professional way to outline repayment terms between individuals, helping to prevent misunderstandings and protect both parties. It promotes trust, accountability, and financial clarity.

Take control of your personal lending arrangements today—download our Personal Debt Agreement Template and create a fair, transparent agreement!

Personal Debt Agreement Template – WORD