When you make a purchase, whether online or in person, you are often provided with a sales receipt. This small piece of paper may seem insignificant at first glance, but it serves as proof of purchase and a record of a completed transaction.

A sales receipt confirms that a buyer has paid for goods or services and provides important details like the items purchased, total cost, and payment method. Both customers and businesses benefit from having a sales receipt for purposes such as returns, accounting, and tax documentation.

What is a Sales Receipt?

A sales receipt is a document that acknowledges a payment made in exchange for goods or services. It typically includes details such as the date of the transaction, the items purchased, the quantity of each item, the total cost, the payment method used, and any applicable taxes or discounts.

This record is essential for both customers and businesses as it serves as proof of purchase and can be used for various purposes.

Why Do You Need a Sales Receipt?

A sales receipt is crucial for both customers and businesses for several reasons:

Proof of Purchase

One of the primary reasons to keep a sales receipt is to have proof of purchase. In case of any issues with the purchased items or the need for a refund, a sales receipt serves as evidence that the transaction took place and that the buyer paid for the goods or services. Without a sales receipt, customers may face challenges in proving their purchase.

Returns and Exchanges

When it comes to returning or exchanging items, a sales receipt is essential. Many retailers require a sales receipt as part of their return policy to verify the purchase. Having a sales receipt simplifies the process and increases the likelihood of a successful return or exchange, ensuring a smoother experience for customers.

Accounting Purposes

Businesses rely on sales receipts for accounting purposes. Sales receipts provide a detailed record of transactions, which is crucial for tracking sales, monitoring inventory, calculating profits, and preparing financial reports. Without accurate sales receipts, businesses may struggle to maintain organized financial records.

Tax Documentation

For both individuals and businesses, sales receipts play a crucial role in tax documentation. The information on sales receipts helps in determining deductible expenses, calculating sales tax, and reporting income accurately to tax authorities. Having organized and detailed sales receipts is essential during tax season to ensure compliance and minimize the risk of audits.

What to Include in a Sales Receipt?

When creating a sales receipt, make sure to include the following information:

Date of the Transaction

The date of the transaction is a critical element to include on a sales receipt. It establishes when the purchase took place and helps both the buyer and seller track the timeline of transactions. Having a clear date on the receipt can prevent confusion and facilitate record-keeping.

Names and Contact Information

Include the names and contact information of both the seller and the buyer on the sales receipt. This information is essential for identification purposes and communication. In case of any discrepancies or follow-up queries related to the transaction, having accurate contact details on the receipt can expedite resolution.

Description of Items Purchased

A detailed description of the items purchased should be included on the sales receipt. This includes information such as the name of the product or service, the model or serial number if applicable, and any specific details that differentiate the item from others. Providing a clear description helps in identifying the purchased items accurately.

Quantity of Each Item

Specify the quantity of each item purchased on the sales receipt. Whether it’s multiple units of the same item or different quantities of various products, noting the quantity helps in verifying the accuracy of the transaction. This information is particularly useful for businesses managing inventory.

Total Cost

The total cost of the purchase should be clearly stated on the sales receipt. This includes the sum of all items purchased, any applicable taxes, shipping charges, or discounts. The total cost provides a comprehensive overview of the transaction’s financial aspects and ensures transparency between the buyer and the seller.

Payment Method Used

Indicate the payment method used for the transaction on the sales receipt. Whether the payment was made through cash, credit card, debit card, check, or digital wallets, specifying the payment method provides clarity on how the purchase was completed. This information is valuable for reconciling accounts and tracking payment trends.

Applicable Taxes or Discounts

If there are any taxes applied to the purchase or discounts availed by the buyer, these should be clearly mentioned on the sales receipt. Including details about taxes and discounts ensures that the final amount paid is accurately reflected on the receipt. This transparency helps in understanding the pricing breakdown and any additional charges applied.

How to Organize Your Sales Receipts

Organizing your sales receipts is important for easy retrieval and record-keeping. Consider the following tips:

Use a Filing System

Implement a structured filing system to organize your sales receipts efficiently. Whether you prefer a physical filing cabinet or a digital folder on your computer, categorize your receipts based on date, vendor, or type of expense. Having a systematic approach to filing ensures that you can easily locate specific receipts when needed.

Digitize Your Receipts

Consider digitizing your paper receipts to reduce clutter and enhance accessibility. Scanning your receipts and storing them electronically not only saves physical space but also provides a convenient way to search, sort, and back up your receipts. Digital receipts are also less prone to damage or loss compared to traditional paper receipts.

Keep Track of Online Receipts

In today’s digital age, many transactions occur online, leading to digital receipts and invoices. Create a separate folder in your email or cloud storage to store digital receipts systematically. Organize your online receipts by date, vendor, or category to streamline retrieval and ensure all transaction records are consolidated in one accessible location.

Label Your Receipts

To enhance the organization of your sales receipts, consider labeling each receipt with relevant information. Add brief descriptions or keywords on the receipts to identify the purpose of the transaction, the items purchased, or any unique details. Labeling your receipts simplifies the sorting process and helps in quickly identifying specific transactions.

Tips for Successful Sales Receipt Management

Managing your sales receipts efficiently can save you time and headaches in the long run. Here are some tips for successful sales receipt management:

Regularly Reconcile Your Receipts

Consistently compare your sales receipts with your bank or credit card statements to ensure accuracy. Reconciliation helps identify any discrepancies, unauthorized charges, or missing transactions. By regularly reviewing and reconciling your receipts, you can maintain financial transparency and monitor your expenses effectively.

Keep Backups

Make it a practice to create backups of your important receipts to avoid loss or damage. Store physical copies of receipts in a secure location and consider backing up digital receipts on external hard drives, cloud storage, or accounting software. Having backups ensures that you can retrieve and reference receipts even if the original copies are misplaced or destroyed.

Set Aside Time for Organization

Dedicate specific time intervals, whether weekly or monthly, to organizing and filing your sales receipts. Use this time to review your receipts, remove any unnecessary paperwork, and ensure that all transactions are accurately documented and filed. Consistent organization and maintenance of receipts prevent accumulation and confusion in the long term.

Consult a Professional

If you feel overwhelmed or uncertain about managing your sales receipts effectively, seek guidance from an accountant, bookkeeper, or financial advisor. Professionals can provide expert advice on receipt organization, record-keeping best practices, and compliance with tax regulations. Consulting a professional ensures that you are maintaining accurate financial records and maximizing the benefits of your sales receipts.

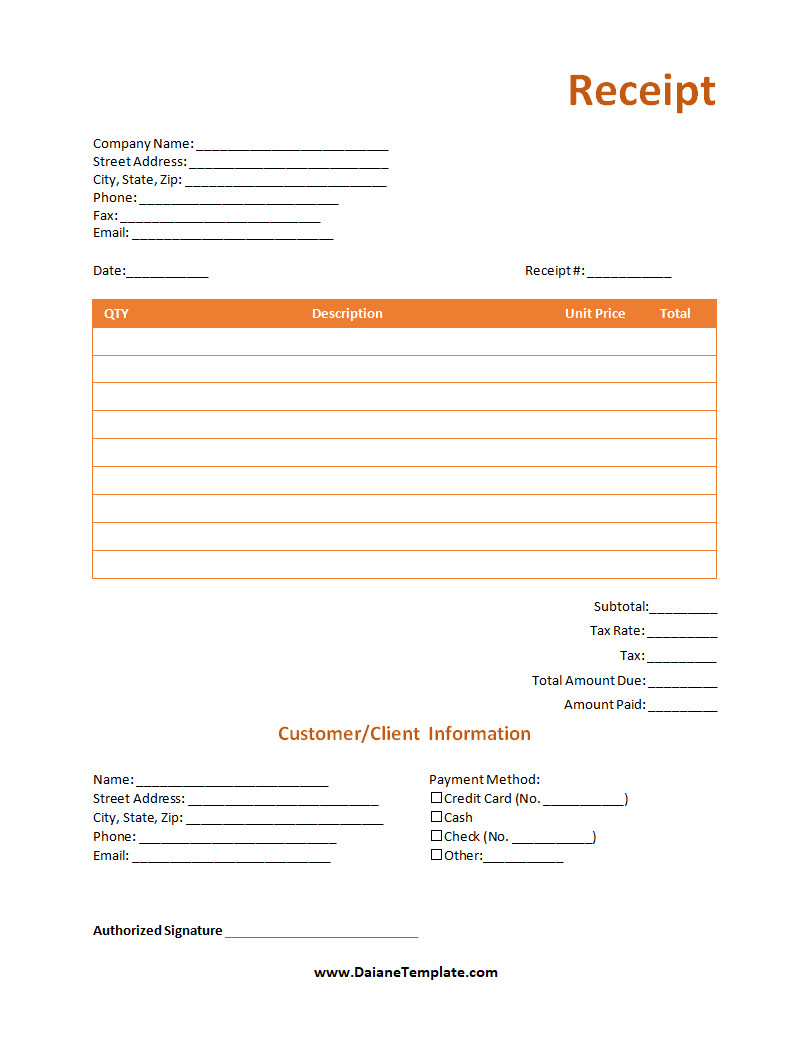

Free Sales Receipt Template

In conclusion, a Sales Receipt is a simple and professional way to record transactions and provide proof of purchase for your customers. It helps you maintain accurate financial records and build trust in every sale.

Keep your business organized—download our Sales Receipt Template and start creating professional receipts today!

Sales Receipt Template – DOWNLOAD