Managing finances as a couple can sometimes feel like a daunting task. However, with the right strategies in place, it can be a rewarding and empowering experience. Setting up a couple budget not only helps you track your expenses and savings but also fosters open communication and teamwork in your relationship.

In this comprehensive guide, we will explore the importance of a couple budget, what to include, how to set it up, and tips for successful budgeting as a couple.

What is a Couple Budget?

A couple budget is a financial plan that outlines how you and your partner will manage your money together. It involves tracking your income, expenses, savings, and investments to ensure that you are both on the same page when it comes to your financial goals. By creating a couple budget, you can avoid conflicts, reduce financial stress, and work towards a secure financial future as a team.

Why is a Couple Budget Important?

A couple budget is essential for several reasons. First and foremost, it helps you and your partner have a clear understanding of your financial situation. By tracking your income and expenses together, you can identify areas where you may need to cut back or save more.

Additionally, a couple budget promotes transparency and accountability in your relationship, fostering trust and teamwork. It also helps you set and achieve common financial goals, whether it’s saving for a vacation, buying a house, or planning for retirement.

What to Include in a Couple Budget

When creating a couple budget, there are several key components to consider. These include:

- Income: List all sources of income for both partners, including salaries, bonuses, and any other earnings.

- Expenses: Track all expenses, such as rent or mortgage, utilities, groceries, transportation, entertainment, and debt payments.

- Savings: Include savings goals, emergency funds, retirement contributions, and any other long-term financial plans.

- Debts: List all outstanding debts, including credit card balances, student loans, and car loans.

- Financial Goals: Set short-term and long-term financial goals that you both want to achieve together.

- Review and Adjust: Regularly review your budget and make adjustments as needed to stay on track.

How to Set Up a Couple Budget

Setting up a couple budget may seem overwhelming at first, but with the right approach, it can be a straightforward process. Follow these steps to create a successful couple budget:

1. Gather Financial Information

Start by gathering all your financial information, including bank statements, bills, pay stubs, and investment accounts. This will give you a clear picture of your current financial situation.

2. Determine Your Financial Goals

Sit down with your partner and discuss your short-term and long-term financial goals. Whether it’s saving for a vacation, buying a home, or planning for retirement, having clear goals will help you prioritize your spending.

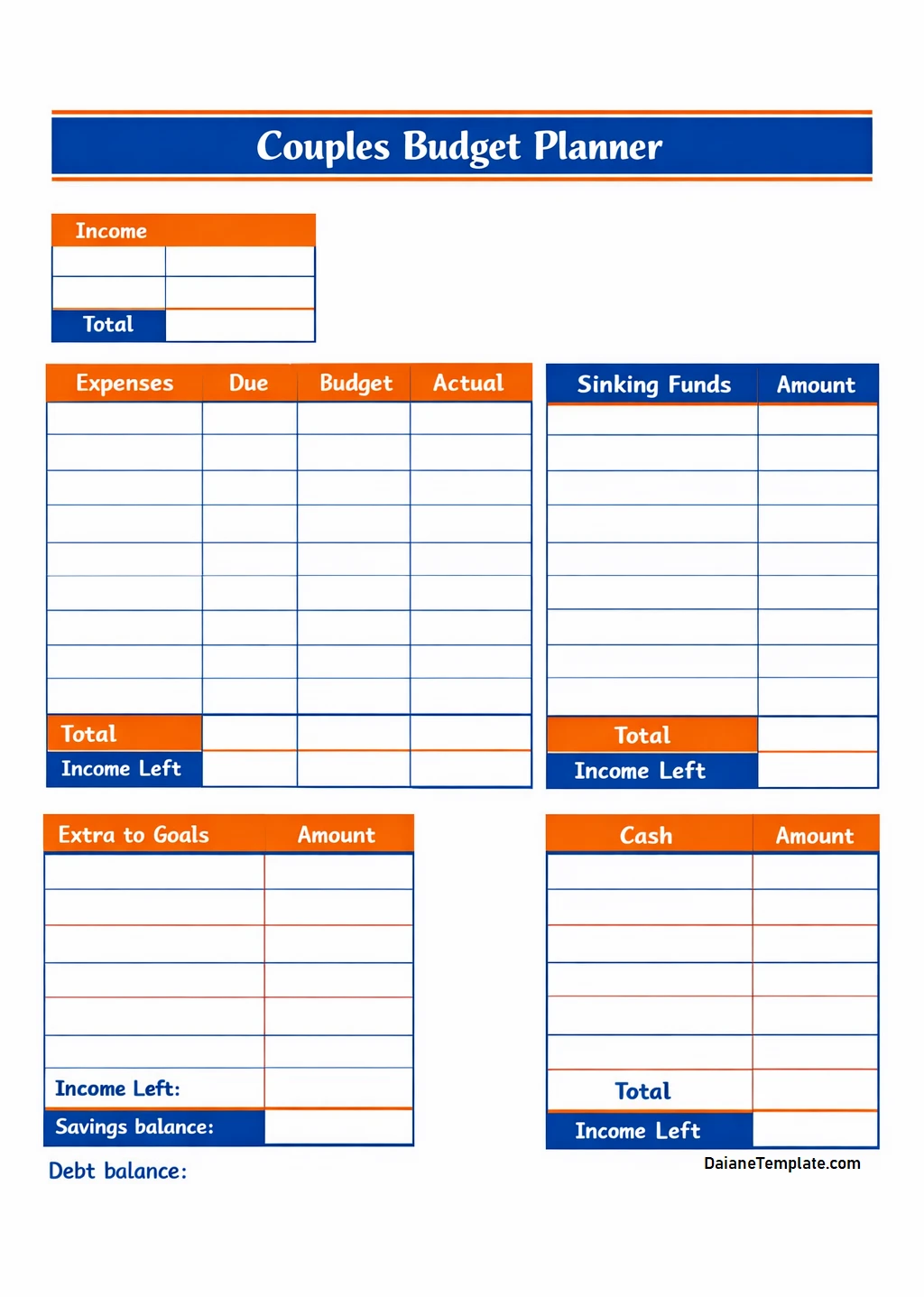

3. Create a Budget Template

Use a budget template or software to outline your income, expenses, savings, and debts. Be sure to categorize your expenses and allocate funds for each category according to your priorities.

4. Track Your Expenses

Keep track of your expenses on a regular basis to ensure that you are staying within your budget. This may involve using a budgeting app, keeping receipts, or using a spreadsheet to track your spending.

5. Review and Adjust Regularly

Set aside time each month to review your budget and make any necessary adjustments. This will help you stay on track and make informed decisions about your finances as a couple.

6. Communicate Openly

Communication is key when it comes to managing a couple budget. Be open and honest with your partner about your financial goals, concerns, and challenges. Working together as a team will help you overcome any obstacles and achieve financial success.

Tips for Successful Couple Budgeting

Managing a couple budget requires effort and commitment from both partners. Here are some tips to help you successfully navigate the world of couple budgeting:

- Set Realistic Goals: Be realistic about your financial goals and prioritize what’s most important to both of you.

- Communicate Effectively: Keep the lines of communication open and discuss any financial concerns or challenges openly.

- Celebrate Small Wins: Celebrate your financial achievements, no matter how small, to stay motivated and on track.

- Seek Professional Help: If you’re struggling with your finances, don’t hesitate to seek help from a financial advisor or counselor.

- Be Flexible: Life is unpredictable, so be prepared to adjust your budget as needed to accommodate changes in your circumstances.

- Work as a Team: Remember that you and your partner are in this together. By working as a team, you can overcome any financial challenges that come your way.

By following these tips and strategies, you can create a successful couple budget that helps you achieve your financial goals and strengthen your relationship along the way.

Couple Budget Template – Download