The employee direct deposit form is a crucial document that allows employees to formally give their employer permission and banking details to electronically transfer their wages directly into their bank account. This process replaces the traditional paper checks, ensuring secure, accurate, and timely payment.

The direct deposit form typically includes the employee’s banking information, such as the account and routing numbers, and is a vital step in setting up electronic payroll.

What is an Employee Direct Deposit Form?

An employee direct deposit form is a document that authorizes an employer to electronically deposit an employee’s salary directly into their bank account.

This form eliminates the need for paper checks and offers a more convenient and secure way of receiving payment.

Why is an Employee Direct Deposit Form Important?

The employee direct deposit form is essential for both employees and employers for several reasons:

- Convenience: Direct deposit eliminates the need to visit a bank to deposit a physical check.

- Security: Electronic transfers are more secure than paper checks, reducing the risk of lost or stolen payments.

- Efficiency: Direct deposit ensures timely payment, as funds are transferred directly into the employee’s account on payday.

- Cost Savings: Employers save on check printing and distribution costs by using direct deposit.

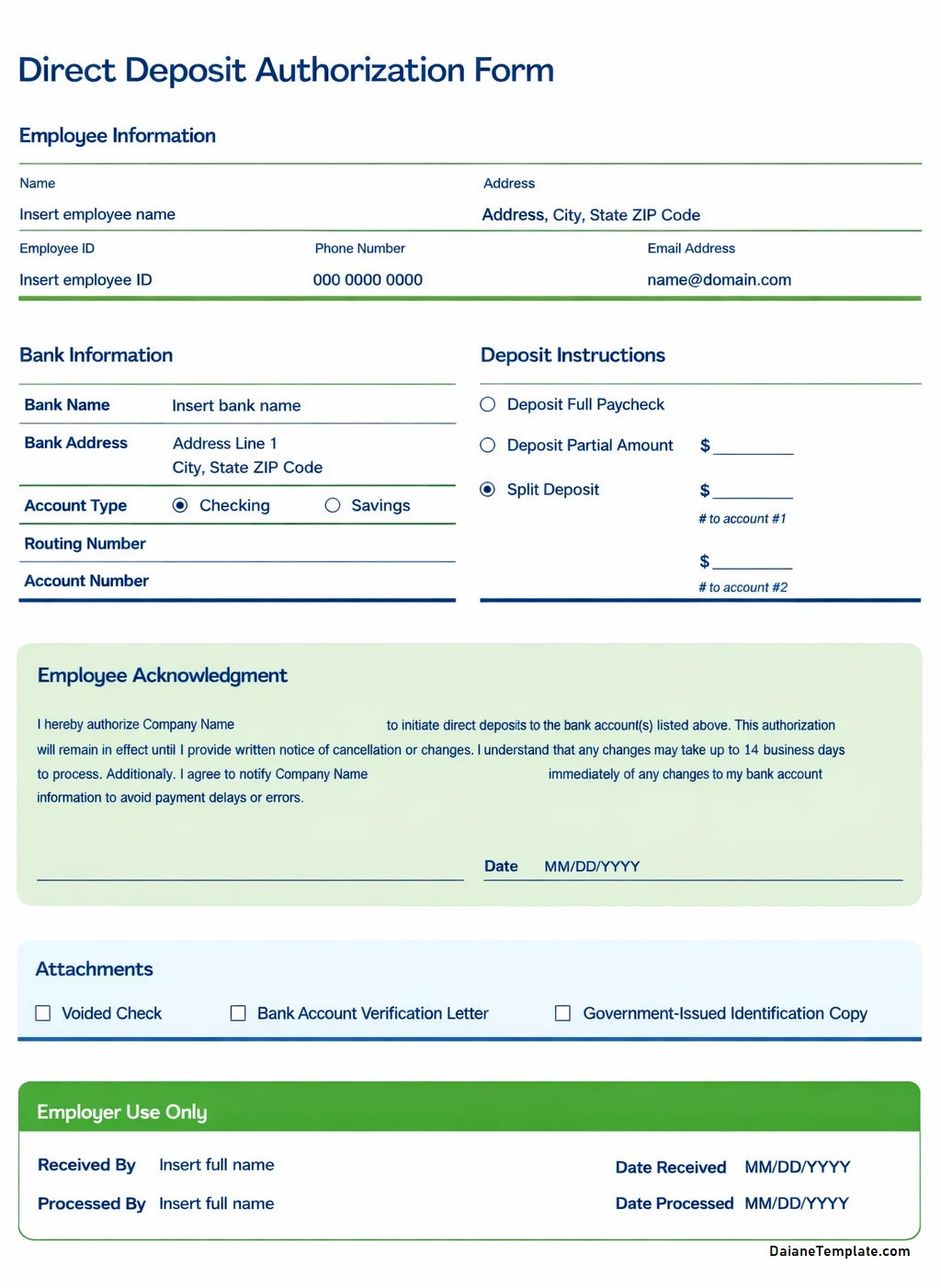

Key Elements of an Employee Direct Deposit Form

When filling out an employee direct deposit form, there are several key elements to consider:

- Employee Information: Name, address, social security number, and contact details.

- Bank Information: Account number, routing number, and type of account (checking or savings).

- Authorization: Employee’s signature authorizing the direct deposit.

- Notification: Instructions for notifying the employer of any changes to the bank account.

How to Fill Out an Employee Direct Deposit Form

Completing an employee direct deposit form is a straightforward process. Here are the steps to follow:

- Obtain the Form: Ask your employer for the direct deposit form.

- Provide Personal Information: Fill in your name, address, and social security number.

- Add Bank Details: Enter your bank account number, routing number, and account type.

- Sign the Form: Sign the form to authorize the direct deposit.

- Submit the Form: Return the completed form to your employer for processing.

Tips for Successful Employee Direct Deposit

To ensure a smooth direct deposit process, consider the following tips:

- Double-Check Information: Verify that all information on the form is accurate to prevent any payment delays.

- Notify Changes Promptly: Inform your employer promptly of any changes to your bank account to avoid payment issues.

- Keep a Copy: Retain a copy of the completed direct deposit form for your records.

- Review Pay Stubs: Regularly review your pay stubs to confirm that payments are being deposited correctly.

In Conclusion

The employee direct deposit form is a convenient and secure way for employees to receive their wages directly into their bank accounts. By following the steps outlined in this guide and adhering to best practices, both employees and employers can benefit from the efficiency and reliability of electronic payroll processing.

Employee Direct Deposit Form Template – DOWNLOAD